Thread/

This whole Trust Wray and these other fuck sticks from Q has to be a mirror. Direct fucking opposite

Thread/

I got hit in the mouth by a baseball in Pony League. It ripped open my lower lip. My parents were at work but there was a policeman in his car watching us. He took me to my Aunt's house for repairs.A Good Cop Story To Start The Day. Don't just howl when they do something wrong. Also remember when they do good, like this guy. I hope his town and Chief appreciate him.

Watch: Officer escorts elderly woman walking along busy highway to hair salon

The 84-year-old woman had taken a nearly 45-minute bus ride and was about to walk another mile to get to her destination before Officer Lance Hofmeister offered to take her the rest of the way.www.fox26houston.com

How about a Good Cop Story Day. That is a good story @imprimisI got hit in the mouth by a baseball in Pony League. It ripped open my lower lip. My parents were at work but there was a policeman in his car watching us. He took me to my Aunt's house for repairs.

No cap gains up to $500k if you live in it as your residence for 2 years.I spoke with a Realtor yesterday about a property she is selling for a former client of mine I did the termite work on. Her client is an investor with an interesting M.O. He buys a house, moves in and does the repairs while living there, then sells it 2-3 years later. He rinses and repeats. Seems like a pain to do it that way. Maybe it has tax advantages for him - repair costs, moving expenses and the costs to buy and sell. Maybe the utilities are deductible, too.

A new twist on living while the government pays the expenses? Section 8 for the entrepreneur.

I bought my current home from interior decorators that do exactly this.No cap gains up to $500k if you live in it as your residence for 2 years.

If the house is your primary residence for 2+ years you avoid capital gains tax.I spoke with a Realtor yesterday about a property she is selling for a former client of mine I did the termite work on. Her client is an investor with an interesting M.O. He buys a house, moves in and does the repairs while living there, then sells it 2-3 years later. He rinses and repeats. Seems like a pain to do it that way. Maybe it has tax advantages for him - repair costs, moving expenses and the costs to buy and sell. Maybe the utilities are deductible, too.

A new twist on living while the government pays the expenses? Section 8 for the entrepreneur.

I spoke with a Realtor yesterday about a property she is selling for a former client of mine I did the termite work on. Her client is an investor with an interesting M.O. He buys a house, moves in and does the repairs while living there, then sells it 2-3 years later. He rinses and repeats. Seems like a pain to do it that way. Maybe it has tax advantages for him - repair costs, moving expenses and the costs to buy and sell. Maybe the utilities are deductible, too.

A new twist on living while the government pays the expenses? Section 8 for the entrepreneur.

Time stamp @44Bobcats55.If the house is your primary residence for 2+ years you avoid capital gains tax.

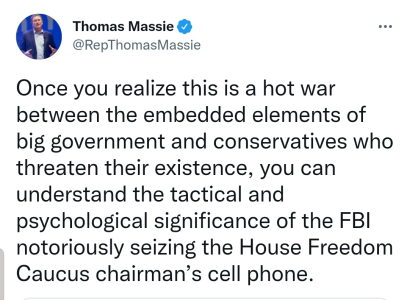

The warrant left at Mar-a-lago wouldn’t have the probable cause statement. It would only have the items to be searched for and the law they believe is being or has been broken.Beck said that the warrant was flashed to the attorneys at MaraLago, they were not allowed to view it, nor to even be within 10 feet of it.

View attachment 126297

View attachment 126299

FBI delivers SUBPOENAS to Pa lawmakers after taking Perry's phone

The FBI paid visits to Republicans in the Pa House and Senate Wednesday to look for information connected to U.S. Rep. Scott Perry and his scheme to install alternate electors in 2020.www.dailymail.co.uk

View attachment 126300

Daily News on GETTR: "The White House on Wednesday warned that Iran wil...

"The White House on Wednesday warned that Iran will face severe consequences for an attack on any U....gettr.com

^^Kind of out of the blue, prepping us for going full war in the ME again^^

FBI's Wray seemingly deflects question on planting evidence, says he's 'concerned' over threats

Wray said he could not speak about the matter and referred the reporter to the FBI.justthenews.com

Tim Scott does not know what time it is

He is not a wartime consigliere

When the Republicans take Congress we need a special committee into August 8th

I’ll believe the FBI isn’t corrupt when the Clintons and the Obamas go down for spying on Trump.

He’s a POS. Probably bought for far less than Lindsay ‘blue oyster’ Graham.Scott isn't ignorant, he's a wolf in sheep's clothing.

He’s a POS. Probably bought for far less than Lindsay ‘blue oyster’ Graham.

He’s a POS. Probably bought for far less than Lindsay ‘blue oyster’ Graham.

I spoke with a Realtor yesterday about a property she is selling for a former client of mine I did the termite work on. Her client is an investor with an interesting M.O. He buys a house, moves in and does the repairs while living there, then sells it 2-3 years later. He rinses and repeats. Seems like a pain to do it that way. Maybe it has tax advantages for him - repair costs, moving expenses and the costs to buy and sell. Maybe the utilities are deductible, too.

A new twist on living while the government pays the expenses? Section 8 for the entrepreneur.

To be more precise, as long as it is your primary residence in 2 of the last 5 years you qualify for the CG exemption. We bought a house remodeled it for 2 years while living there and made it a short term rental. We sold it before year 5 and excluded the first $500k of cap gains.If the house is your primary residence for 2+ years you avoid capital gains tax.

How many times can you do that?To be more precise, as long as it is your primary residence in 2 of the last 5 years you qualify for the CG exemption. We bought a house remodeled it for 2 years while living there and made it a short term rental. We sold it before year 5 and excluded the first $500k of cap gains.

Yah crazy old man replying to myself.The FBI has to be disbanded the same with the CIA. They were created by Executive Order and can be removed with the stroke of a pen.

Obama has had over 30 million records since he left office and not one word about this at all.

View attachment 126294

Perpetually, but only once in a 2 year period.How many times can you do that?