-

In Memory of Rebarcock.

As we navigate life without Pat 'Rebarcock.' Flood, who passed on Sept 21, 2025, we continue to remember the profound impact he had on our community. His support was a cornerstone for our forum. We encourage you to visit the memorial thread to share your memories and condolences. In honor of Pat’s love for storytelling, please contribute to his ‘Rebarcock tells a story’ thread. Your stories will help keep his spirit alive among us.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Master Thread Dance Your Cares Away/Fraggle/Law Abiding Citizens

- Thread starter Bryan74b

- Start date

Master Threads

Nobody trolls better

As she spiels her shit with a white toupee on her nasty looking bean.

Vivek is saying much of what people want Trump to do on his return to office. Yet, Vivek falls behind the two deep staters, DeSantis and Haley.

Dems.

As things in this country continue to deteriorate, minds may be changed.

Looks like they want to insulate themselves from Trump's Reckoning.

Everyone of hunter's cohorts met with the big guy.

You have to see this guys Twitter feed - he goes from Dallas is Trump to the "media" is helping Trump LOLOL

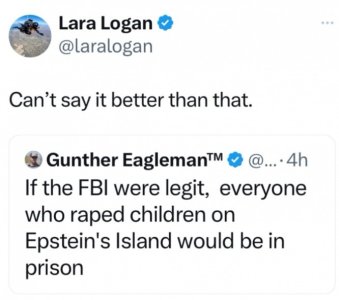

Someone get Miriam the Epstein list for starters.

Jake Broe Stan

Elite

The government’s interest bill has fallen in recent decades as a share of the economy, thanks to lower borrowing costs over the period. Net interest as a percentage of GDP, without adjusting for inflation, has averaged about 1.5%, though it climbed to 1.9% in 2022 after the pandemic borrowing surge.

Factor in inflation, and interest-to-GDP has frequently been negative, even before the burst of post-COVID price increases. Looking ahead, the White House Office of Management and Budget expects Yellen’s measure to rise back above zero in 2024, as inflation ebbs, and then to top out at 1.1% in 2032-33. That’s a level the Treasury secretary says is “quite reasonable.”

The metric favored by Yellen is the right one to use, Furman says, because it’s important to factor in the opposite effects that interest costs and inflation have on the debt burden.

When rates and prices are both going up, Furman says that “in one sense, next year’s debt is even bigger than this year’s debt, because it goes up with interest. But in another sense, next year’s debt is smaller, because part of it is inflated away and so you don’t need to pay back as much.”

time.com

time.com

Factor in inflation, and interest-to-GDP has frequently been negative, even before the burst of post-COVID price increases. Looking ahead, the White House Office of Management and Budget expects Yellen’s measure to rise back above zero in 2024, as inflation ebbs, and then to top out at 1.1% in 2032-33. That’s a level the Treasury secretary says is “quite reasonable.”

‘Inflated Away’

Jason Furman, a professor at Harvard University and former economic adviser to President Barack Obama, agrees. In a 2020 paper, he and former Treasury Secretary Lawrence Summers argued that policymakers should aim to keep real net interest from rising above 2% of GDP.The metric favored by Yellen is the right one to use, Furman says, because it’s important to factor in the opposite effects that interest costs and inflation have on the debt burden.

When rates and prices are both going up, Furman says that “in one sense, next year’s debt is even bigger than this year’s debt, because it goes up with interest. But in another sense, next year’s debt is smaller, because part of it is inflated away and so you don’t need to pay back as much.”

Why Janet Yellen Doesn’t Lose Sleep Over U.S. Borrowing

Yellen embraces an alternative method for measuring the sustainability of the nation’s debt.

Jake Broe Stan

Elite

This is probably the first time you ever read the room correctly.I don't buy this. Trump Jr and Tucker have both said horribly terrible things about Haley. Trump listens to those 2. No way he doesn't know how bad she's hated by the base. I feel like this is the same people who said Judge Napolitano was going to be his SC pick... Not really insiders but just someone in the orbit talking shit.

Jake Broe Stan

Elite

The orcs are losing aircraft left and right and none of them can be replaced thanks to western sanctions.

Slava America! Slava Ukraini!

Slava America! Slava Ukraini!

Jake Broe Stan

Elite

It was so nice to see Trump get a big win last night.

If he and Biden face off it’s going to be popcorn worthy TV.

If Biden withdraws then The Dems are going to be facing the weakest candidate the GOP could put forward. The inverse is true as well if Trump gets removed off the ballot by The Supreme Court.

Slava America!

If he and Biden face off it’s going to be popcorn worthy TV.

If Biden withdraws then The Dems are going to be facing the weakest candidate the GOP could put forward. The inverse is true as well if Trump gets removed off the ballot by The Supreme Court.

Slava America!

A morning smile.........

Call 911 We Have the Murder of a Naysayer on Twitter

Oil problems

Call 911 We Have the Murder of a Naysayer on Twitter

Body bagged

While she is dishonest, her ignorance is her characteristic that stands out the most. She is purely a stupid person.

🍊SpicyCuban17 on GETTR : It’s -30 degrees here in MT at the wind farm in Judith Gap this morning, and not a single wind turbine is turning. Coal, oil, and natural gas are necessary now and for the foreseeable future to supply our base load electric

It’s -30 degrees here in MT at the wind farm in Judith Gap this morning, and not a single wind turbine is turning. Coal, oil, and natural gas are necessary now and for the foreseeable future to supply our base load electric needs! https://x.com/reprosendale/status/1746208420871688233?s=46...

Biden Responds to Trump's Iowa Win, Complains About 'Extreme MAGA Republicans' | The Gateway Pundit | by Cassandra MacDonald

Joe Biden responded to former President Donald Trump’s landslide victory in Iowa by complaining about “extreme MAGA Republicans.” The mainstream media, including the Associated Press, called the caucuses for Trump just 30 minutes after they began.

Maddow meltdown: Trump a dangerous fascist, but his supporters are worse

MSNBC host Rachel Maddow blamed former President Donald Trump’s landslide victory in the Iowa caucuses on a “radicalized” Republican primary electorate Monday.

www.wnd.com

www.wnd.com

Similar threads

- Replies

- 13

- Views

- 571

- Replies

- 6

- Views

- 313

- Replies

- 0

- Views

- 2K

- Replies

- 56

- Views

- 5K

Latest posts

-

Master Thread Dance Your Cares Away/Fraggle/Law Abiding Citizens

- Latest: TheRealJohnCooper

-

-

-