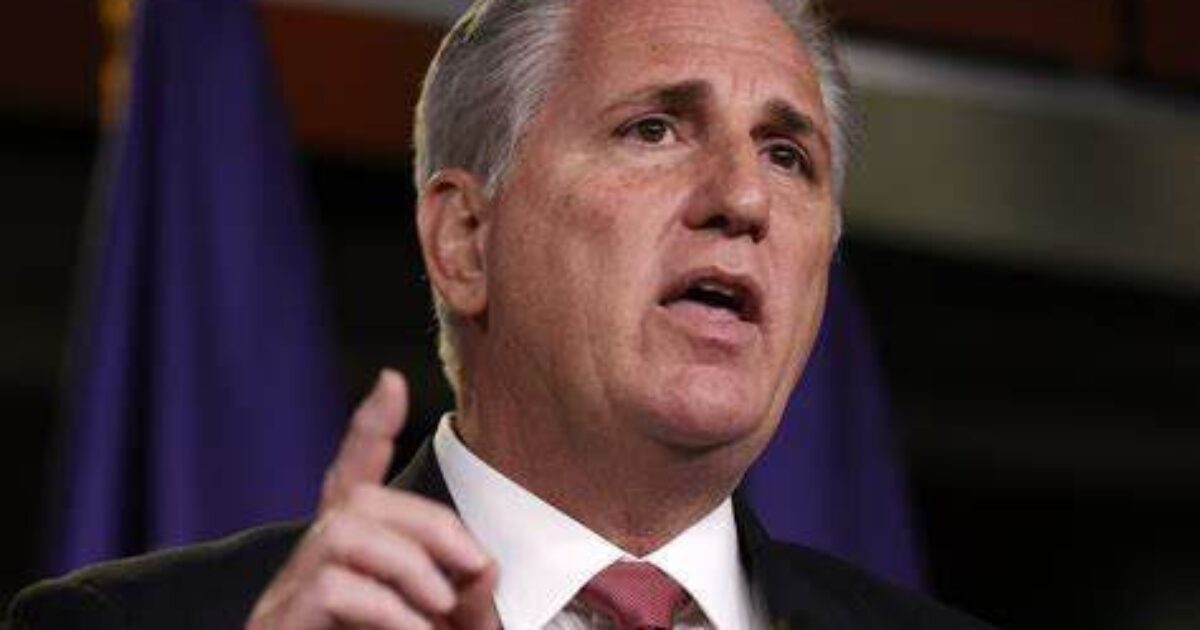

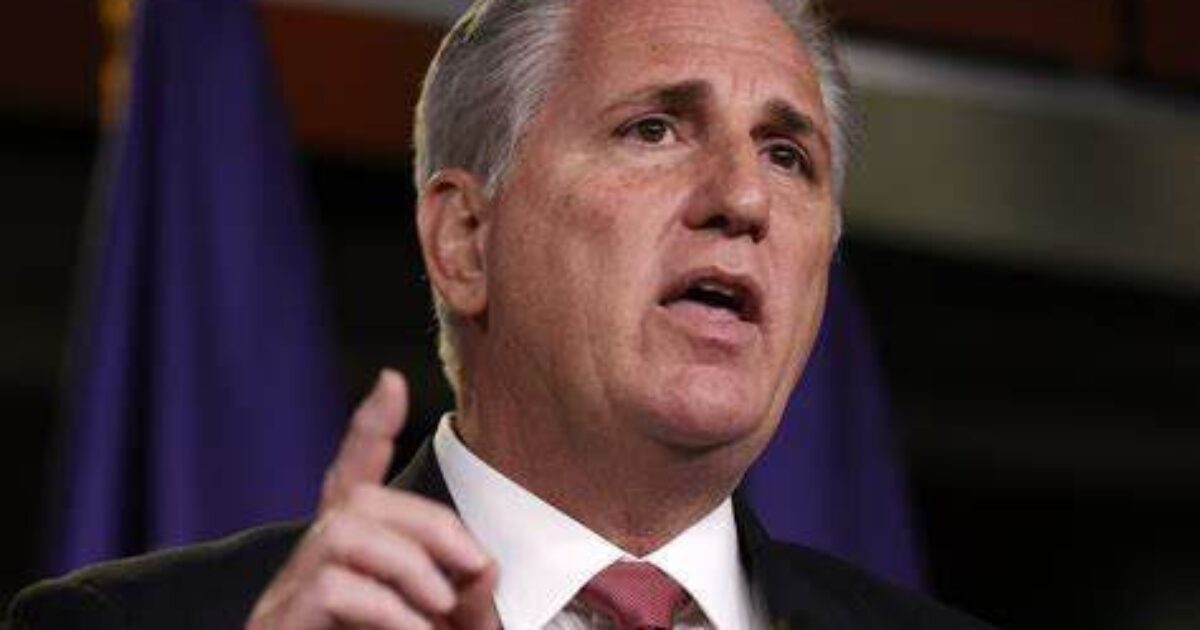

McCarthy Giving Jan 6th Footage To More News Outlets

The establishment’s Jan 6th narrative is falling apart.Advertisement Kevin McCarthy initially gave January 6th footage to Tucker Carlson – more ...

As we navigate life without Pat 'Rebarcock.' Flood, who passed on Sept 21, 2025, we continue to remember the profound impact he had on our community. His support was a cornerstone for our forum. We encourage you to visit the memorial thread to share your memories and condolences. In honor of Pat’s love for storytelling, please contribute to his ‘Rebarcock tells a story’ thread. Your stories will help keep his spirit alive among us.

See-eye-aye, or FBI, everybody and everything that’s involved is crooked as hell, nothing is gonna come out, and I hate to say that, but I think that the state and swamp is way too deep. And the client list for Epstein island, nothing will be shown on that, everybody making every decision with what’s going on Right now, as leverage with who is on that list, no one will ever find out who they are.Notice nothing came out on the Awan House IT scandal and the Awan guy she was fucking. He took one for the Packies on that spy ops.

What the ‘House IT Scandal’ was really about

The family of four Pakistani-Americans had unusual access to Congressional computers, for years, in the innermost sanctums of the US Capitol and in the offices of dozens of national lawmakers. Then…nypost.com

JUST IN: Massive Group of Military-Age Males Storm Port of Entry in El Paso in Effort to Get Into US (VIDEO) | The Gateway Pundit | by Cristina Laila

Joe Biden’s America.www.thegatewaypundit.com

Biden Caves To Conservatives, Will Allow Drilling In Arctic

PRESIDENT MAKES DECISION AHEAD ON WILLOW PROJECT CALLwww.offthepress.com

Good thing Trump got with India.Huge deal. India ignores Biden's pressure and expands oil deals with Russia.

Greatly underming the USD and the Petro Dollar.

Country's are walking away from the USA and Biden he is killing American trade and business.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Tourney. OU could have won the tourney and received a bid to the Madness. They didn’t and they didn’t.So, which conference championship means more? Regular season or tourney?

None of this would have happened if the DemBitches had not stole his Presidency.Good thing Trump got with India.

Another Bank Run.

Boston Private

Ghetto Bank.Looks poor. SKOL!

Stanford won't do anything. Notice all the liberal women Deans they have? That may be the source of their problems.

Vinyls are the best. I've got about 500 albums and play them often.

Another Bank Run.

Boston Private

I am thinking BLACK MONDAY. For the stock marketsMonday (tomorrow) it could get really ugly see run rumors in quite a few places.

Depends on how levered the different assets were.

It could be 1:5-1:10 in some asset classes. In others, it could be 1:20+ That ratio is going to determine how much the interest rate impacts the value of long-term securities being used to back deposits.

In an SV=based bank, the additional complexities of warrants, equity, etc..., which SVB used to help fund the entire startup & VC-backed ecosystem, it becomes even more complex.

What we are seeing here is nothing new, but ultimately boils down to trust. When the consumer trusts the system, it functions, to a point. When trust is lost, the entire system can come crashing down in hours. There is a reason Goodwill is a line item on the Balance Sheet. This isn't limited to banking/finance/VC/PE, but also extends into the healthcare system, education, etc... Pretty much most sectors of the global economy.

@MortgageHorn what is your take on the impact to a homeowner who is current on payments, locked in over the past 2 years at below 3% and the bank they have their mortgage with goes into receivership?

Regular season without a doubt.So, which conference championship means more? Regular season or tourney?

Stanford won't do anything. Notice all the liberal women Deans they have? That may be the source of their problems.

Vinyls are the best. I've got about 500 albums and play them often.

Is the gov't going to go after all the stock trades from insiders at SVB? Probably not if they were donors to the dems.

Again, I don't watch the brainwashing tube so I've never heard of this incident which means nothing to me.