10,9,8,7,6,5,4,3,2,1...

-

In Memory of Rebarcock.

As we navigate life without Pat 'Rebarcock.' Flood, who passed on Sept 21, 2025, we continue to remember the profound impact he had on our community. His support was a cornerstone for our forum. We encourage you to visit the memorial thread to share your memories and condolences. In honor of Pat’s love for storytelling, please contribute to his ‘Rebarcock tells a story’ thread. Your stories will help keep his spirit alive among us.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Master Thread Dance Your Cares Away/Fraggle/Law Abiding Citizens

- Thread starter Bryan74b

- Start date

Master Threads

The GOAT Novak!

Everyone is piling on Jimbo and aggie

Kid must have been born a sinner...

Truth!

My next door neighbor just got arrested for growing marijuana.

I guess my property line isn't where I thought it was.

I guess my property line isn't where I thought it was.

Your take on this is right on. Consider that typical govt. policy as compared to the Amazon news earlier. Amazon can down size in a week. Govt. can never downsize.The Australian Central Bank last week stated they are Bankrupt. The Covid Policies Bankrupted Australia, and they said they would print their way out. These people are all insane. Instead of laying off government workers, ending useless government programs and down sizing governments to suit income. They will continue their piracy and plunder of the tax payer.

FreeMiner

Legendary

In my humble opinion, Trump was a pussy. He should have ended as many Departments as possible that are not mandated in the Constitution. DC for example has no business in Education. The reason Universities are shit and teach useless shit an cost so much for students is because they are funded by DC. Just one example.Your take on this is right on. Consider that typical govt. policy as compared to the Amazon news earlier. Amazon can down size in a week. Govt. can never downsize.

This right here. It’s too brewed there will never be a study to find out how many were killed by for sale docs

Everyone is piling on Jimbo and aggie

Or maybe Jimbo is a snake oil salesman and the aggie "braintrust" has dementia.

Couldn't you smell the skunk? I smell it everywhere when people open their doors of their cars or houses. if I were a thief I could be rich just from taking a handful of ganja I've seen over the years in people's houses and apartments. Went into an apartment in Waco and a man was breaking down a kilo of pot into baggies. I was inside for 10 minutes and he never looked at me.My next door neighbor just got arrested for growing marijuana.

I guess my property line isn't where I thought it was.

Yea the fucking economy and the world's economy!

I’m illiterate when it comes to economics. The dollar is losing value at home but gaining internationally. Is this because those dollars internationally are coming back home by other countries selling off?

Basically, is it that there are less dollars in circulation globally which increases the dollar value outside of the US while there’s an influx of money coming home which causes a loss of value at home?

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

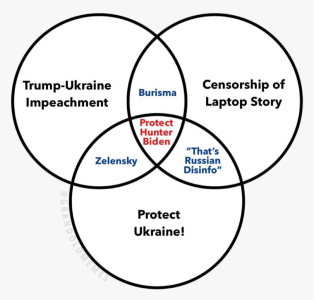

I saw a Q reference somewhere earlier so I have a Q question. This certainly paints him in a different light than Q painted him IIRC. Q basically said he was CIA. So how do the current Q believers take this article?

I’m illiterate when it comes to economics. The dollar is losing value at home but gaining internationally. Is this because those dollars internationally are coming back home by other countries selling off?

Basically, is it that there are less dollars in circulation globally which increases the dollar value outside of the US while there’s an influx of money coming home which causes a loss of value at home?

I don't know jack either but it seems that other currencies are in a free fall and by default, the $ is getting stronger.

You are correct in that dollars held international will at some point come home and they'll be making a killing, but wouldn't it devalue the $ when that happens?

I thought the Fed printing presses have been running non stop for the last decade or so. Not sure how much they are pulling out of circulation to offset that. Thus,, inflation.

The financial markets confuse the hell out of me. Only thing I can surmise is that everything is linked together and any move central banks make at this point backfires.

I’m illiterate when it comes to economics. The dollar is losing value at home but gaining internationally. Is this because those dollars internationally are coming back home by other countries selling off?

Basically, is it that there are less dollars in circulation globally which increases the dollar value outside of the US while there’s an influx of money coming home which causes a loss of value at home?

There’s a lot of variables at play.I don't know jack either but it seems that other currencies are in a free fall and by default, the $ is getting stronger.

You are correct in that dollars held international will at some point come home and they'll be making a killing, but wouldn't it devalue the $ when that happens?

I thought the Fed printing presses have been running non stop for the last decade or so. Not sure how much they are pulling out of circulation to offset that. Thus,, inflation.

The financial markets confuse the hell out of me. Only thing I can surmise is that everything is linked together and any move central banks make at this point backfires.

Key driver to US strength is rate hikes. The Fed is hiking rates faster than other currencies, so more yield is earned holding dollars. This is important to note as markets tumble- where do you put cash?

Additionally, in global turmoil, cash is moved to “safe” currencies where there is less volatility, historically that’s the USD and JPY.

With JPY collapse, the USD is all that’s left. This is all creating dollar demand. Specifically RE turmoil, the US has been mostly shielded from the European chaos: Russia, energy etc.

Finally, USD strength is great for consumers who buy stuff from overseas but terrible for local manufacturing as it makes them less competitive overseas: their costs are higher in USD and must sell goods for more.

Another wrinkle is that US companies that have earned revenue overseas at some point will need to bring that money back, however, they’ll now get crushed on the exchange rate. Imagine you had 50MM GBP in the bank with an expected exchange rate of 1.30-1.35 that you would repatriate and distribute to share holders / pay US costs.

If that exchange rate is now 1.10, you’ve just lost ~20% value in your cash.

.

Last edited:

There’s a lot of variables at play.

Key driver to US strength is rate hikes. The Fed is hiking rates faster than other currencies, so more yield is earned holding dollars. This is important to note as markets tumble- where do you put cash?

Additionally, in global turmoil, cash is moved to “safe” currencies where there is less volatility, historically that’s the USD and JPY.

With JPY collapse, the USD is all that’s left. This is all creating dollar demand. Specifically RE turmoil, the US has been mostly shielded from the European chaos: Russia, energy etc.

Finally, USD strength is great for consumers who buy stuff from overseas but terrible for local manufacturing as it makes them less competitive overseas: their costs are higher in USD and must sell goods for more.

Another wrinkle is that US companies that have earned revenue overseas at some point will need to bring that money back, however, they’ll now get crushed on the exchange rate. Imagine you had 50MM GBP in the bank with an expected exchange rate of 1.30-1.35 that you would repatriate and distribute to share holders / pay US costs.

If that exchange rate is now 1.10, you’ve just lost ~20% value in your cash.

.

Thanks for the professional insight. Based on what you are seeing, you hear talk of a financial reset(both good and bad), is it inevitable that this happens?

D

Deleted member 2886

Guest

So, Truth Social has gone full blown Q. Devin, Kash, Trump, all of them aren’t even pretending anymore. What day you guys??

•Probably ain't gonna be a popular opinion, currently i—strongly suspect this whole "Q" thang is an extremely elaborate ultra-cunty deception campaign.

•What i am seeing is an intense rhetorical manipulation strategy being employed consistently.

•Appealing to/& distracting the majority of those whom–could—potentially organize and rapidly proliferate into what would likely, imfho, be, the most significant-organized force of resistance in the history of mankind, arising against the so-called one world fuckwit order.

•Know the TRUTH about—& of, the tragic destruction of the Ian Smith led-[*fmr Sth] Rhodesia.[¿?]

•How did that vile communist Mugabe—with the flailing Zanla conscript forces, eventually collapse & gut Rhodesia [¿?]

•i point that out coz, as ya'z will certainly be aware, it seems a very similar long-term infiltration tactic is apparently occuring,...

...via your[*USA] borders.

•Check this out;- here's a gif from a video of an additional-particularly alarming aspect.

•What if they are actually trafficking children as a means of "currency", thus requiring an adequate organizatioal structure.[¿?] At the current shocking rate, there must be just as much relative pressure on the entire covert US based traffickers logistical capacities.[¿?]

•Am stoned af, and just speculating that maybe the pressure may serve to more clearly expose the pedovore networks main arteries,...

...coz surely there'd be some inherent—& exploitable correlation-with regard to the tracking of the ~11 odd million+ foreign invaders.[¿?]

•[*¿potentially commie conscripts lurking amongst ya'z?]

•That's just the retarded version of what i reckon anyway.

•Hey, @TheRealJohnCooper obviously i'm significantly less knowledgeable of the reality of living in the states, please excuse my likely ignorance of terms specific to within 'The US©', may i annoy the shit outta ya by inquiring as to your pro-badass opinion on the following ramblings;

•i'm curious about when an "agent" for "principal", such as a regular "law enforcement officer", concludes the "administration" of the 'Miranda Warning' to a "third party" by then seemingly—"asking" a simple "question" like;-

• ["...ave the right to stop any time. Do you understand?"]

[Just for simplicity, presuming the "third party" is completely adhering to/& acting in accordance within all relevant 'Principal' obligations defined in 'Law']

•Would it be accurate to interpret;- ["...Do you understand?"]—as actually an implicit offer/proposal to enter into a legally enforceable contract?

•And if, at least perhaps somewhat similarly so, would this 'contract' also therefore be legally "entered into" whereupon the 'third party' has "reasonably" demonstrated a voluntary adherence to one very particular—explicitly stated 'contractual' "term" set out in the 'Miranda Warning' recital,...i.e;- ["...the right to remain silent."]

[•#END OF RANT•]

Charlie Kirk on GETTR : Of these 7, which is your top priority? 1 - Defund 87,000 IRS Agents 2 - Impeach Mayorkas and Garland 3 - Investigate and reconstitute FBI/DOJ 4 - Save the Military from the Wokes 5 - Block all Gov’t funding until the border

Of these 7, which is your top priority? 1 - Defund 87,000 IRS Agents 2 - Impeach Mayorkas and Garland 3 - Investigate and reconstitute FBI/DOJ 4 - Save the Military from the Wokes 5 - Block all Gov’t funding until the border is secure 6 - Impeach Biden 7 - Election integrity While tempting...

New York City Democrats push to ABOLISH NYPD gang database as crime soars

The NYPD have said that the database, which contains alleged gang member names, is a “critical component of modern policing and an invaluable tool for detectives investigating crime.”

Not your bullion not your gold - paper gold is to wipe your ass

How many people on here lost gold on their boat with their guns in a horrible accident??

New York City Democrats push to ABOLISH NYPD gang database as crime soars

The NYPD have said that the database, which contains alleged gang member names, is a “critical component of modern policing and an invaluable tool for detectives investigating crime.”

Financial reset just talk for us conspiracy theorists. Not something that’s considered in the markets(at the time). Couldn’t even imagine what that would look like, but would certainly be easier to do with 15% interest and crashing markets complemented with wild inflation.Thanks for the professional insight. Based on what you are seeing, you hear talk of a financial reset(both good and bad), is it inevitable that this happens?

^^reads more like they just call him a bad boy^^

Labour Opens Up Massive Lead In UK Polls | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The War Has Just Begun | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Q-1971 🐸 SANi ™️ on GETTR : Republican Candidate For Senate Receives ‘Cease Desist’ Letters For Pointing Out Democratic Failures Tiffany Smiley received the orders from Starbucks and the Seattle Times for her ad where she stands in front of one of

Republican Candidate For Senate Receives ‘Cease Desist’ Letters For Pointing Out Democratic Failures Tiffany Smiley received the orders from Starbucks and the Seattle Times for her ad where she stands in front of one of the chain’s abandoned stores, and features headlines from the liberal...

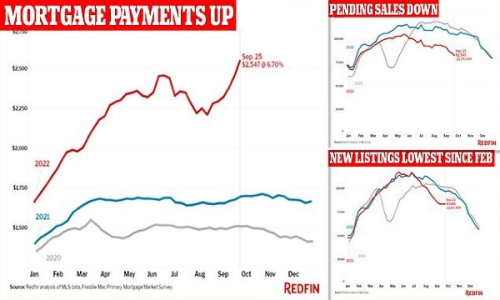

Typical mortgage payment has soared $337 in just six weeks

The average US homeowner saw their monthly mortgage payment rise by 15 percent or $337, according to a shocking new report from Redfin.

Trump slams ‘racist’ NY AG Letitia James for fraud lawsuit at Michigan rally

Former President Donald Trump railed against “racist” New York Attorney General Letitia James for filing a lawsuit alleging “staggering” fraud against him and his family last month during a rally i…

Biden admin is continuing the Obama admin's 'war on whistleblowers': Glenn Greenwald

Independent journalist Glenn Greenwald shares how the "war on whistleblowers" has eroded trust among Americans and abroad on "Unfiltered with Dan Bongino."

Biden tapping tax dollars to boost Dem registration, turnout, warn House GOP, voting watchdog

Suspecting partisan intent behind an executive order instructing federal agencies to submit plans to expand political participation, nine ranking committee members warned administrators against "engaging in the Biden Administration's political activities."

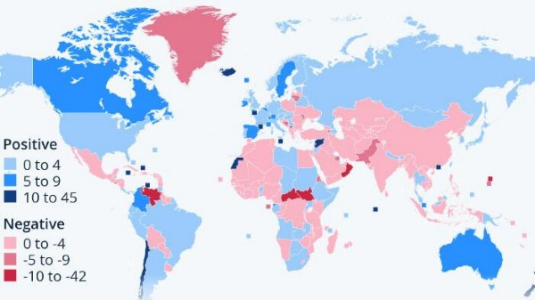

^^https://www.zerohedge.com/geopolitical/global-overview-human-migration^^

The Thinnest Veneer of Civilization

To be able to eat, to move about, to have shelter, to be free from state or tribal coercion, to be secure abroad, and safe at home - only that

^^^^^^^^

Democrats Fail Up

I woke up Saturday morning and, unlike most Saturday mornings, I didn’t have any idea what this column was going to be about. Usually, I have something in mind, something

Hurricane Kamala is a Danger to Society

The Vice President of the United States, Kamala Harris, is proving to be the perfect complement to Joe Biden. She mangles what she says almost every other time she's in

Bill Maher: It’s Time for Kamala Harris to Retire

Vice President Kamala Harris has made it apparent she doesn’t know what she’s doing. She says just enough to get by and then makes a run for it before reporters

Similar threads

- Replies

- 13

- Views

- 526

- Replies

- 4

- Views

- 210

- Replies

- 0

- Views

- 2K

- Replies

- 56

- Views

- 4K