BigBucnNole

Elite

- Joined

- Jan 15, 2021

- Messages

- 2,158

Good or bad? Discuss.

By registering with us, you'll be able to discuss, share and private message with other members of our community.

SignUp Now!So bad for a long time but good for a short time.

Kind of like Gas prices going up $3 / gallon but coming back fdown $1 / gallon. They are still up $2 gallon.

Inflation is the #1 concern for Americans at this moment. Sleepy Joe needs to show the people that he is concerned about their rapidly rising grocery and energy bills.

When was it bad?

The first half of the year. The headline says that it "bounced back". Maybe it bounced back from being good?

It wasn't necessarily terrible, i agree. But the headline uses bounced back so that doesn't exactly exude a good connotation.

Well…..call me crazy BUT I will wait for *Corrected figures to come out. Before I start to celebrate!

Now who wants to bet that they come back and adjust this number downward? @FatBucdCuckedNole ?

Because we produced less gross domestic product?You know why GDP was negative?

For the same reason the reported low on it and unemployment under Trump........Why they adjusting it down?

Because we produced less gross domestic product?

My big dirty American dick inside your mothers mouth.What is a gross domestic product?

My big dirty American dick inside your mothers mouth.

That is a gross domestic product bitch

Be curious where the revision comes. Hard to believe the economy did better this quarter than the last 2. I guess maybe oil and gas exports might of bumped us up.

Probably not ever so.... but I follow it. I'm not as smart as you. Hell. I thought inflation would continue to be problem through the fall and winter and into next year. You thought it was transitory and you definitely hit that.Because you follow it ever so closely?

Probably not ever so.... but I follow it. I'm not as smart as you. Hell. I thought inflation would continue to be problem through the fall and winter and into next year. You thought it was transitory and you definitely hit that.

How do you not think it is transitory? You one of these tards that think 8% yoy is permanent?

Its the total value of product produced by the United States.What is a gross domestic product?

It’s significantly less than 8%.If inflation is only 8% then I'm the pope.

Which you and @Rube Reaper are on, and speaking with just sayingAhh yes, about what I'd expect from the low information block.

.001

Oh boy. You went to an expensive school and probably even spent more than 4 years didn't you?How do you not think it is transitory? You one of these tards that think 8% yoy is permanent?

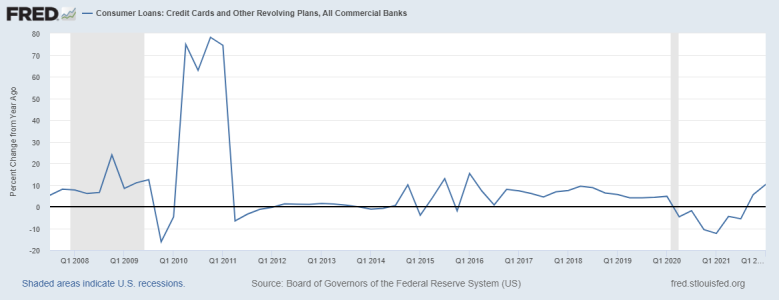

https://www.cbsnews.com/news/credit-card-interest-rates-debt-inflation/

Searing inflation is driving Americans to make more purchases on their credit cards, leading leading them to amass more debt that is becoming costlier as the Federal Reserve hikes interest rates.

Early in the pandemic, many families had more cash on hand as they cut their spending on things like dining out and as the federal government rolled out a range of financial assistance programs, such as stimulus checks. That helped them pay off billions in credit card debt.

As of the second quarter, Americans owed $887 billion in credit card debt, up 13% from the year-ago period. Nearly six in 10 Americans who earn less than $50,000 a year carry a credit card balance from month to month, according to CreditCards.com.

"The Fed's decision to raise interest rates is going to continue to impact people with credit card debt because that means their interest rates are rising and they owe more as a result," Bhattarai said.

I know. Just pointing out cc debt going up since early this year. That might be problem in the future with rates going higher... or not.lol @ CBS

Good thing rates aren't going up on that debt. Also good that disposable income isn't getting beat worse than Ike beat Tina.Household debt as a percent of disposable income... looks terrifying

View attachment 145769

annual snapshot, again terrifying...

View attachment 145771

I got a cnn link that says household debt rose to it's highest level in 2021 since 2007... We know how 2008 turned out with a little inflation. And that goes to 2021.... You may have not noticed but the inflation has cut into savings and disposable income this year. You aren't one of those rich dudes that doesn't realize everyone doesn't have a 6 figure income right? I mean... Median income is like $60000 or something. $4 gas, 8% mortgage rates and 8%+ inflation on everything hurts those people... median speaking.

Nope. You're just wayyyy smarter than me. The economy is doing awesome. Inflation is barely up. Interest rates and national debt don't matter. Lets all buy more stocks and smoke a cigar.That would be a lie?

View attachment 145788

I don't know wat the rest of your nonsense post says outside of not having a clue for basic economics.

Do you have even a most rudimentary idea of how 2008 happened????

Nope. You're just wayyyy smarter than me. The economy is doing awesome. Inflation is barely up. Interest rates and national debt don't matter. Lets all buy more stocks and smoke a cigar.

Which you and @Rube Reaper are on, and speaking with just saying

I agree. I am probably incapable of understanding how inflation could affect 2/3rds of the country. I'll just monitor this thread going forward for more wisdom.You got nothing? Why's it bad? Everything you've said shows to be wrong. Seems a case of when "doing your own research" goes wrong.

I agree. I am probably incapable of understanding how inflation could affect 2/3rds of the country. I'll just monitor this thread going forward for more wisdom.

Last question though. Did you post that because the bear market is done and the bulls are running and we are back to good?Probably for the best.