Retaliation at the fixed bases we have in the ME.how do we lose thousands of troops from a "strike" against Iran? An invasion sure, but a strike?

-

In Memory of Rebarcock.

As we navigate life without Pat 'Rebarcock.' Flood, who passed on Sept 21, 2025, we continue to remember the profound impact he had on our community. His support was a cornerstone for our forum. We encourage you to visit the memorial thread to share your memories and condolences. In honor of Pat’s love for storytelling, please contribute to his ‘Rebarcock tells a story’ thread. Your stories will help keep his spirit alive among us.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Master Thread Dance Your Cares Away/Fraggle/Law Abiding Citizens

- Thread starter Bryan74b

- Start date

Master Threads

Is this really a good time to be bringing back animals that are clearly higher on the food chain?

This is completely dangerous. Playing God won’t end well for these people.

Seriously, wtf Bobby? They all talk big till shown their file. All of them!

newsbreak.com

newsbreak.com

RFK Jr., a vocal critic of vaccines, is now advocating for the MMR vaccine to stop measles from spreading in Texas - NewsBreak

Kennedy previously touted Vitamin A as a possible treatment for the highly contagious disease.

I hear ya brother, at least it’s MMR that’s been around since 1971, so it’s probably one of the few “good” ones. But, overall I 100% agree with you, we need a fucking win and soon!Seriously, wtf Bobby? They all talk big till shown their file. All of them!

RFK Jr., a vocal critic of vaccines, is now advocating for the MMR vaccine to stop measles from spreading in Texas - NewsBreak

Kennedy previously touted Vitamin A as a possible treatment for the highly contagious disease.newsbreak.com

ShaolinNole

Legendary

Ain’t no way I am talking about climate change with the hot Asian-Kazakh girl that flirts with me for 20 minutes while cutting my hair.

I like listening to Forrest, but just because you can, doesn't mean you shouldThis is completely dangerous. Playing God won’t end well for these people.

I hear you. But daggum is this new MMR the same as the old MMR? Why is this measles such a killer? Poor diet, pre-existing conditions, had the covid jab, all the above plus others? Who knows? But it appears pretty dark and hopeless so maybe the light is coming. Skol brother!I hear ya brother, at least it’s MMR that’s been around since 1971, so it’s probably one of the few “good” ones. But, overall I 100% agree with you, we need a fucking win and soon!

Is this really a good time to be bringing back animals that are clearly higher on the food chain?

No

About how I feel at this moment.

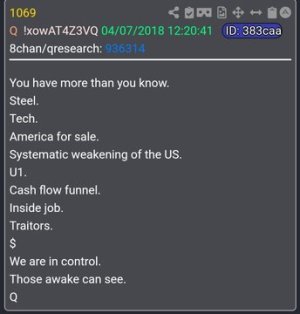

This is the new qfs system coming online

First question i always ask.. vaxxed or notI hear you. But daggum is this new MMR the same as the old MMR? Why is this measles such a killer? Poor diet, pre-existing conditions, had the covid jab, all the above plus others? Who knows? But it appears pretty dark and hopeless so maybe the light is coming. Skol brother!

I'm writing to you as a paramedic and father, with rage and disgust I never thought I'd direct at you.

Let me be crystal clear, I watch people die. Not in abstract statistics or clinical trials, I watch them take their last breaths while I'm knuckle deep in their chest cavity doing compressions. I pronounce teenagers dead who collapsed on basketball courts. I hold the hands of confused elderly patients as they experience strokes with no risk factors. I see the blood clots, the sudden cardiac arrests, the unexplainable neurological events.

This isn't coincidence. This isn't normal. And you know it.

For years, you stood as one of the few voices willing to speak truth about the pharmaceutical capture of our regulatory agencies. You documented the corruption, the conflicts of interest, the suppression of safety signals. You gave hope to those of us watching this nightmare unfold in real time.

And now? You're promoting the same shots you once questioned. You're playing political footsie with the very system you exposed as fundamentally corrupt. You're offering "resources" to push more MMR vaccines while standing at the graves of children.

What happened to your spine?

I don't give a damn about political realities or the "long game" you might think you're playing. While you calculate your political survival, I'm calculating time to hospital for myocarditis cases in teenagers. While you craft carefully worded statements, I'm crafting incident reports for deaths that will never be properly investigated.

Unlike physicians, paramedics don't take oaths. We don't need to. Our commitment is demonstrated every time we run toward danger while others run away. Every time we tell hard truths when others offer comfortable lies.

My children deserve better than this medical tyranny. The patients I serve deserve better than regulatory capture masquerading as public health. And the movement you helped build deserves better than your betrayal.

You can't serve two masters, Kennedy. Either stand with the truth or admit you've surrendered to the machine.

The bodies are piling up. Autism is the new normal. The evidence is overwhelming. And your political calculations won't mean shit to history when the full scope of this disaster is finally acknowledged.

Find your courage or get the hell out of the way.

With utter disgust,

Harry Fisher

Paramedic and Father

Play on words for what he called PanicansWhat is plani

I don't believe the market graph shown is accurate. I think it was like 37,900ish

Last edited:

I don't believe the market graph shown is accurate. I think it was like 37,900ish

It is always about money. While I have to have it to function in this society I can name 3 things that come before it. God, family, country. If any of those three are compromised for the almighty quid then I am out. We have leaders who think that is the be all end all and quite frankly I am sick of this usury based money means everything it's just business philosophy. I am sure most even in here lives revolve around money. Our society should be working less for more and it should be easier to keep out of the hands of these petulant weasels we call politicians. If we focused on the first three societally the money will be a natural byproduct not THE product. JMHO Skol!

RU486. I think everyone has heard the term of eighty-sixing something. In polite terms it means to get rid of, or terminate. The abortion pill was named are you for eighty-sixing your child. No online publication I can find has the balls to admit this. Its time for Jesus to set thing right.

I asked Grok about this. Appears to be all short term fluctuating not a serious harbinger of dire outcomes longterm

Conclusion

You’re likely correct that China dumping Treasuries won’t stop the Fed from dropping rates if economic conditions warrant it—growth and employment remain key drivers. Long-term, the U.S. could benefit from reduced foreign debt reliance, a stronger export sector, and a push toward fiscal discipline, though short-term volatility and inflation are risks. The outcome hinges on how policymakers and markets respond, but the U.S. economy’s depth and adaptability suggest it could turn this challenge into an opportunity.

Potential Economic Advantages for America if China Dumps U.S. Treasury Bonds

Less Foreign Debt Dependence: Reduces reliance on foreign capital, encouraging domestic investors to buy more Treasuries.

Dollar Depreciation Boosts Exports: Lower dollar value makes U.S. goods cheaper abroad, potentially shrinking trade deficits and boosting manufacturing.

Pressure for Fiscal Discipline: Higher yields increase borrowing costs, pushing the U.S. to address deficits and spending sustainably.

Market Resilience: Deep Treasury market can absorb sell-off with buyers like Japan or U.S. institutions stepping in, maintaining confidence.

Trade Rebalancing: Accelerates decoupling from China, fostering reshoring and supply chain diversification for long-term security.

Why This Might Be Beneficial in the Long Run

Addresses Imbalances: Shifts economy toward exports, savings, and production, reducing reliance on trade deficits and foreign financing.

Potential Risks: Higher borrowing costs and inflation could slow growth or hurt consumers if not managed well.

Net Outcome: Benefits depend on U.S. adaptation, but could strengthen economic resilience over time.

eighty sixing comes from the mafia in Vegas. Take him 8 miles out of town and bury him 6 ft under.RU486. I think everyone has heard the term of eighty-sixing something. In polite terms it means to get rid of, or terminate. The abortion pill was named are you for eighty-sixing your child. No online publication I can find has the balls to admit this. Its time for Jesus to set thing right.

Shield wall! Haha Skol!

Not what I was expecting to see... Also, always hold the high ground.

Long Cat V2.0

Legendary

Just left a tour of the capitol. The building is a fortress. No way it was “overrun.” Thats just ridiculous.

Saw Mike Johnson come out of his office and head over to the house chamber. He is actually tiny. Could barely find him in the group of press that was following him.

Everyone survive today's (Checks Notes) 0.9% drop in the market!!!!!!!

We should hang all of the media for stirring up all of this alone. The market probably ends up today if the media didn't run their psychological opeation.

We should hang all of the media for stirring up all of this alone. The market probably ends up today if the media didn't run their psychological opeation.

First time I’ve seen that and it wasn’t at a Denny’s or fast food joint….

Click 1st tweet. Pretty good ryn down on the hidden agendas to destroy DS

I was thinking Waffle House...First time I’ve seen that and it wasn’t at a Denny’s or fast food joint….

Similar threads

- Replies

- 13

- Views

- 545

- Replies

- 4

- Views

- 243

- Replies

- 0

- Views

- 2K

- Replies

- 56

- Views

- 5K