A

Fitch Ratings analyst warned that the U.S. banking industry has inched

closer to another source of turbulence — the risk of sweeping rating downgrades on dozens of U.S. banks that could even include the likes of

JPMorgan Chase.

The ratings agency cut its

assessment of the industry’s health in June, a move that analyst

Chris Wolfe said went largely unnoticed because it didn’t trigger downgrades on banks.

But another one-notch downgrade of the industry’s score, to A+ from AA-, would force Fitch to reevaluate ratings on each of the more than 70 U.S. banks it covers, Wolfe told CNBC in an exclusive interview at the firm’s New York headquarters.

“If we were to move it to A+, then that would recalibrate all our financial measures and would probably translate into negative rating actions,” Wolfe said.

The credit rating firms relied upon by bond investors have roiled markets lately with their actions. Last week, Moody’s

downgraded 10 small and midsized banks and warned that cuts could come for another 17 lenders, including larger institutions like

Truist and

U.S. Bank. Earlier this month, Fitch

downgraded the U.S. long-term credit rating because of political dysfunction and growing debt loads, a move that was

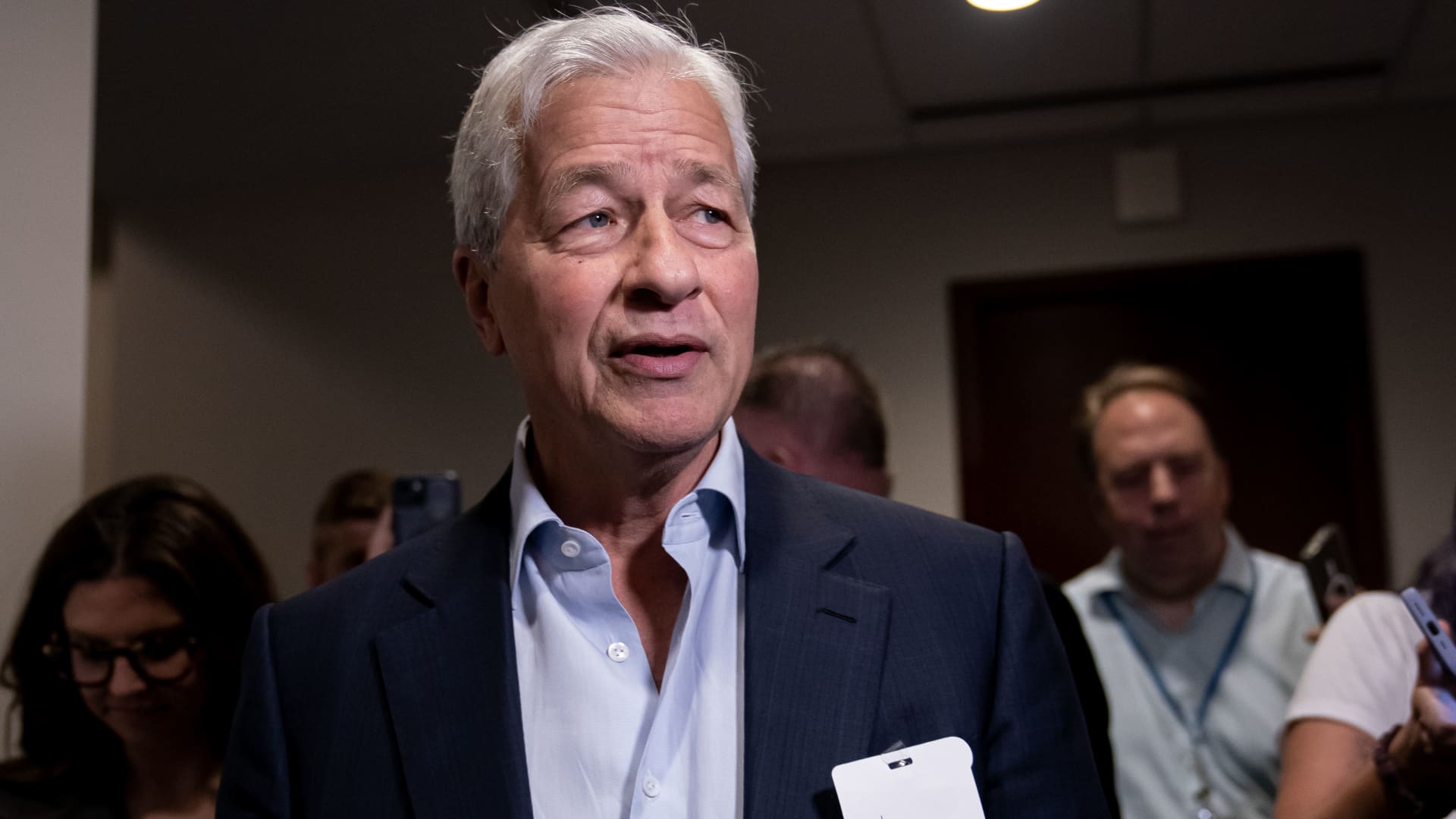

derided by business leaders including JPMorgan CEO

Jamie Dimon.