You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Master Dance Your Cares Away/Fraggle/Law Abiding Citizens

- Thread starter Bryan74b

- Start date

Community megathread

Charlie Kirk on GETTR : Warmonger Lindsey Graham wants to expand NATO to include Ukraine and guarantee an endless proxy war with Russia. I'm sure the the military industrial complex is salivating at the limitless money his resolution would funnel int

Warmonger Lindsey Graham wants to expand NATO to include Ukraine and guarantee an endless proxy war with Russia. I'm sure the the military industrial complex is salivating at the limitless money his resolution would funnel into their coffers. Boooo!! End the endless wars.

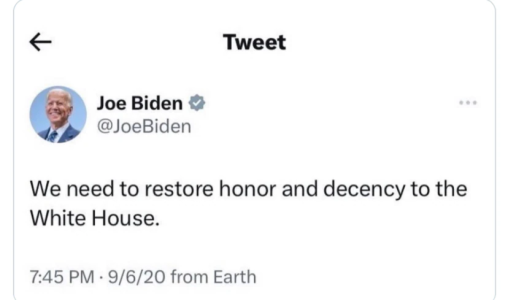

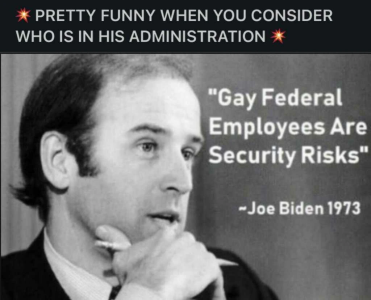

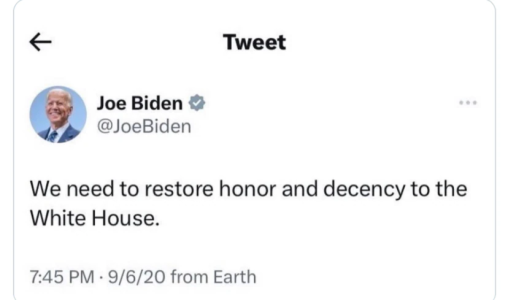

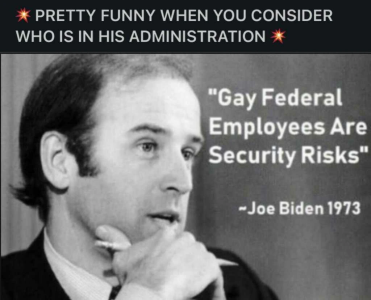

This aged well

This season’s homosexual fetish is buying babies and prancing them around like an accessory. Are you gay and want to harvest a baby from a rental womb? You’ll get a front page spread in the news and a gorillion likes on Instagram. So what happens to the innocent babies after the fad is over and the babies grow into children? They will be discarded like an outdated purse- or worse. This needs to be criminalized. Now.

This season’s homosexual fetish is buying babies and prancing them around like an accessory. Are you gay and want to harvest a baby from a rental womb? You’ll get a front page spread in the news and a gorillion likes on Instagram. So what happens to the innocent babies after the fad is over and the babies grow into children? They will be discarded like an outdated purse- or worse. This needs to be criminalized. Now.

Warning sign? Unemployment claims doubled in some Midwest states

WalletHub compared states’ unemployment claims across milestone weeks to analyze increases in unemployment.

A year after declaring invasion, Texas border judge issues warning to Americans

Judge says her life and the lives of her residents haven’t been the same since Biden took office.

Ant Announces Unexpected Share Buyback At 75% Discount To Botched IPO | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

French Riots Show That Decades Of Mass "Colonizing Immigration" Could Lead To "Collapse", Says Former Head Of French Counter-Intel Agency | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

“I apologize… now look over there”.

FALSE

Here Is The Mortgage Bond Market for the Last Year

View attachment 187409

Here Is The US Dollar Index

View attachment 187410

Jake Cum Stain

I see you dropped a laughing emoji on this post.

It proves just what a fucking dumb-ass you are with your inability to read simple financial charts/data.

This public data available in many places - it's not a right wing talking point.

Also shows you just come in posting absolute bullshit with no valid source of material.

Come on Fed-Boi don't that at least educate you pieces of shit even a tiny bit at Quantico?

I know are trying to troll, and I’m no Trump stan given his position on Ukraine, but to suggest that Trump can’t raise money is laughable. He raised over 35M dollars this last quarter alone which is almost double his Q1 haul.

In fact, Trump is so thoroughly trashing Desantis right now that Vivek is about to overtake Desantis in the polls and Vivek is running an issues campaign.

Vivek is great on a ton of issues btw. I love that he is a proud nationalist!

You do realize that a proud nationalist would not be sending a trillion dollars to a foreign corrupt company?

Of course you don't cum-guzzler because you lack basic comprehension abilities.

Not true but it’s also not as you’re portraying it. Paying to spread US hegemony is typically worth it. Taking down Russia, via Ukraine, is definitely in the best interest of The US and the paltry amount we are sending them is some of the best money The US has spent in a long time.You do realize that a proud nationalist would not be sending a trillion dollars to a foreign corrupt company?

Of course you don't cum-guzzler because you lack basic comprehension abilities.

Here is a video breaking it all down and why the Ukraine conflict has been wonderful for The US and awful for Russia.

Also corruption happens everywhere. Using it as a convenient excuse to also not do the right thing by helping Ukraine defend themselves would be amoral.

Free Speech Forum. It was inevitable we would get trolls and antagonists.I can’t believe people on here, smart people, have not put that imbecile on ignore.

It’s like beating off to a grilled cheese sandwich. You can do it, but damn it’s a lot of work and imagination thinking it is anything else.

FIFYFree Speech Forum. It was inevitable we would get trolls and globalist shills.

The mortgage bond market isn’t US treasuries there kiddo. There is a reason small banks are going belly up and it’s because of the strong demand for government bonds (especially 2 year notes).

Also way to be cute and use a 1 year interval. Over a 50 year interval it’s easy to see that we are at nearly the same rate as in the early 1980s with that also being a relative high value period.

Yes cum-bucket I do realize that and I also know that the mortgage bond market is tied to the long-term economy not the short term.

And that the MBS market is the second-largest debt market in the U.S. behind U.S. Treasuries.

No the banking crisis was caused by banks stupidly placing deposits into long-treasuries yielding less than 1%

As interest rates started to rise due to inflation shorter term debt instruments paid a higher yield due to the FED raising rates.

That caused depositors to move their deposits out of the banks and into money-market funds.

When more money was being withdrawn from banks than they had available they were forced to sell their long-term instruments 10 Year Bonds and MBS. They had to sell these securities marked to market at a huge discount.

This in turn caused a liquidity crises and snow-balled itself into several banks collapsing.

The demand for shorter term securities is due to rising inflation, not good, which has caused an inverted yield curve, because to fight inflation the FED has to raise short-term rates.

But you go on with your "talking points".

So if you know all that, like I pointed out, why did you try to pass off MB market as a broader indicator of inability to purchase when the opposite is true?Yes cum-bucket I do realize that and I also know that the mortgage bond market is tied to the long-term economy not the short term.

And that the MBS market is the second-largest debt market in the U.S. behind U.S. Treasuries.

No the banking crisis was caused by banks stupidly placing deposits into long-treasuries yielding less than 1%

As interest rates started to rise due to inflation shorter term debt instruments paid a higher yield due to the FED raising rates.

That caused depositors to move their deposits out of the banks and into money-market funds.

When more money was being withdrawn from banks than they had available they were forced to sell their long-term instruments 10 Year Bonds and MBS. They had to sell these securities marked to market at a huge discount.

This in turn caused a liquidity crises and snow-balled itself into several banks collapsing.

The demand for shorter term securities is due to rising inflation, not good, which has caused an inverted yield curve, because to fight inflation the FED has to raise short-term rates.

But you go on with your "talking points".

If you know that much you surely know that as rates rise the demand for dollars rises with it as well as treasuries. As long as there is demand for US treasuries then we will always be able to pay for things.

Yes cum-bucket I do realize that and I also know that the mortgage bond market is tied to the long-term economy not the short term.

And that the MBS market is the second-largest debt market in the U.S. behind U.S. Treasuries.

No the banking crisis was caused by banks stupidly placing deposits into long-treasuries yielding less than 1%

As interest rates started to rise due to inflation shorter term debt instruments paid a higher yield due to the FED raising rates.

That caused depositors to move their deposits out of the banks and into money-market funds.

When more money was being withdrawn from banks than they had available they were forced to sell their long-term instruments 10 Year Bonds and MBS. They had to sell these securities marked to market at a huge discount.

This in turn caused a liquidity crises and snow-balled itself into several banks collapsing.

The demand for shorter term securities is due to rising inflation, not good, which has caused an inverted yield curve, because to fight inflation the FED has to raise short-term rates.

But you go on with your "talking points".

Let all of the pedo supporters expose who they really are.

Vivek was on the Breakfast Club. They brought in a "ringer" liberal chick to slam Vivek. It went terrible for her and the breakfast club. Black yt is burning Charlamagne down and just dogging this chick.

It's long but tldr.... she kept saying he hadn't done anything with his life because he wasn't into politics in middle school, high school, college and city or state level.... LOL. Vivek looked good. It was one of the most one sided interviews I've ever seen. It was worse than Acosta with Trump.

It would have been a better video had the dude shut his yap and just let the tape play. It would have been better to just post the original video from the Breakfast Club!

He kept interrupting with his inane 'opinions'. Yo bra!

I can't understand all that ghetto verbiage and it irritates me no end when they don't understand past, present, & future tense, yet they think they're educated!

You are 'educated' when you learn to NOT misuse word tense. That's the whole point of an education... to learn proper English and use it even though you grew up in the ghetto!

If anyone knows a way to ignore replies to a poster i have on ignore I would love to know it.

Yes cum-bucket

Gross

If anyone knows a way to ignore replies to a poster i have on ignore I would love to know it.

Same. I had to ignore people I didn’t want to ignore because Elsa can’t let it go

Similar threads

- Replies

- 13

- Views

- 620

- Replies

- 6

- Views

- 368

- Replies

- 56

- Views

- 5K

- Replies

- 113

- Views

- 10K