Thiel is right about it being a canary in a coal mine. I wouldn't be shocked to learn several foreign banks announce they are accumulating Bitcoin on their balance sheet soon (as a hedge against the what Powell is doing).I agree with Peter Thiel. Cryptos rising reflects a lack of trust in the traditional institutions.

Cryptos are going to be a two horse race in the end. BTC and ETH seem to be winning the race.

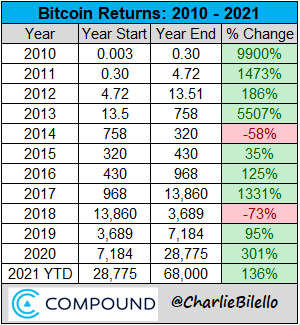

View attachment 58222

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Biden coming after cryptos (@America 1st was right again)

- Thread starter America 1st

- Start date

You are fixated on this but fail to recognize that traditional currencies are used for the same thing.

This issue does not differentiate the two items.

Traditional currencies are authorized by their governments and serve a legitimate purpose.You are fixated on this but fail to recognize that traditional currencies are used for the same thing.

This issue does not differentiate the two items.

Cryptos don’t. You recognize this but apparently don’t value sovereign nations and the will of their respective peoples?

Cryptos are not "authorized", or backed by the full faith and credit of the United States. They do, however, get their authority from mathematical certainty.Traditional currencies are authorized by their governments and serve a legitimate purpose.

Cryptos don’t. You recognize this but apparently don’t value sovereign nations and the will of their respective peoples?

Contrary to your belief, they do serve legitimate purposes. Do some research on the De-Fi movement and see how a transaction would work and then dispute their purposes. The purpose they serve is to enfore a contract without intermediaton or bias.

The government is here to serve the people. When they control the money supply and interest rates they are also picking winners and losers. The block chain takes the power away from the elite and gives it to the people.

Last edited:

This is the exact opposite of how that works.Cryptos are not "authorized", or backed by the full faith and credit of the United States. They do, however, get their authority from mathematical certainty.

Contrary to your belief, they do serve legitimate purposes. Do some research on the De-Fi movement and see how a transaction would work and then dispute their purposes. The purpose they serve is to enfore a contract without intermediaton or bias.

The government is here to serve the people. When they control the money supply and interest rates they are also picking winners and losers. The block chain takes the power away from the elite and gives it to the people.

The government is supposed to control money supply and interest rates. The will of the people should be reflected by their governments / monetary policies not monetary policies being a reflection of a corporate algorithm. Go read my thread on Benjamin Franklin.

I know what De-Fi is and it’s not legitimate. It should be illegal and described as anarchical - at best - or more appropriately as predatory.

At a time when the world should be leaning into sovereign states, and the will of their people, the push by coiners to lean into corporations (via cryptos) is litter Ali just as dangerous, if not more dangerous, than communist China.

This is the exact opposite of how that works.

The government is supposed to control money supply and interest rates. The will of the people should be reflected by their governments / monetary policies not monetary policies being a reflection of a corporate algorithm. Go read my thread on Benjamin Franklin.

I know what De-Fi is and it’s not legitimate. It should be illegal and described as anarchical - at best - or more appropriately as predatory.

At a time when the world should be leaning into sovereign states, and the will of their people, the push by coiners to lean into corporations (via cryptos) is litter Ali just as dangerous, if not more dangerous, than communist China.

I think you just trust the government more than you should. You keep pointing to the government when its the government that has gotten us into the situations that we are in (debt, inflation, wealth gap, increased money supply). People are looking for an alternate route via crypto and the demand is high, just look at its market cap.

There has never been a ban on other currencies. Look at the Yen, Remnibi, Canadian Dollar etc. All currencies compete with another and crypto is just another formidable competitor. Competition is good. No one is forcing people to use crypto, they can still use the dollar if they so choose. Its not taking away anyone's sovereignty.

Banning Crypto is banning freedom of speech. The first amendment which I think @america first should support.

How is taking the bias and intermediation out of a transaction predatory? Read the news about Wells Fargo and their shenanigans a couple years ago? Guess what, that dissappears with crypto. Racial bias in lending? Dissappears. Algorithms are blind, people and governments are not.

Last edited:

And can we at least change the thread title "America First was right again" until BTC dips below its record highs so that people don't accuse us of being a fake news website?

Last edited:

No. You’re freedom of speech doesn’t allow you to participate in any activity (economic or otherwise) then call it legal especially when Congress has the right to regulate economic activity (including what is allowed to be used or traded).I think you just trust the government more than you should. You keep pointing to the government when its the government that has gotten us into the situations that we are in (debt, inflation, wealth gap, increased money supply). People are looking for an alternate route via crypto and the demand is high, just look at its market cap.

There has never been a ban on other currencies. Look at the Yen, Remnibi, Canadian Dollar etc. All currencies compete with another and crypto is just another formidable competitor. Competition is good. No one is forcing people to use crypto, they can still use the dollar if they so choose. Its not taking away anyone's sovereignty.

Banning Crypto is banning freedom of speech. The first amendment which I think @america first should support.

How is taking the bias and intermediation out of a transaction predatory? Read the news about Wells Fargo and their shenanigans a couple years ago? Guess what, that dissappears with crypto. Racial bias in lending? Dissappears. Algorithms are blind, people and governments are not.

Furthermore, debt, inflation, money supply ect are the will of the people and their monetary policy. Just because you don’t like them or the legal appointed leaders that make the decisions about them doesn’t mean they are “bad” or that you have the right to try to bypass government.

We all are required by duty, honor, and law to preserve, protect, and defend The Constitution and to upholds it’s laws and the will of The People (regardless of whether I trust government or not. Spoiler: I don’t).

Demand by high for something isn’t a justification for its existence either. Demand for crack is high. Demand for trafficked humans is high. Need I go on?

Furthermore, the other currencies you pointed out are state issued currencies by sovereign nations not a product issued by a private entity (which is all crypto is). Competition is generally good but not if a certain product undermines national security or the general welfare of the economy in some way. A good example of this would be Trump’s ban Huawei.

Lastly, predatory is a good descriptor because algorithms shouldn’t be deciding contracts without government oversight (The will of The People to protect themselves) nor should people be able to enter into contracts, agreements, or transact business and loans without government consent (The will of The People to protect themselves, their economy, national security, data, ect). We have predatory lending laws, tax laws, required disclosure laws, and many more that wouldn’t be honored under DeFi.

As you pointed out with Wells Fargo the system in place works because The People had laws to oversee WF and protect themselves from their illegal practices once they were caught. Most importantly The People, via government, also had ways to remediate the damage done by WF which also wouldn’t be a given under DeFi.

So are we expecting Bitcoin to take a hit in 2022 or no?

I have no clue. What I do expect is BTC to be around for a long time. Not sure about it’s value though.So are we expecting Bitcoin to take a hit in 2022 or no?

My gut tells me crypto is a new industry in its infancy. Will be some tough roads ahead, but it is here for the duration.

There doesn't seem to be much discussion happening here about what to purchase and why other than the separate HBAR thread. Anyone have any suggestions for places to get good information? I'd appreciate it, thank you!

ETH is my horse. Goldman Sachs and Ken Griffen both agree it will overtake BTC in price one day. It has more uses than BTC, faster transaction times, and uses much less energy.There doesn't seem to be much discussion happening here about what to purchase and why other than the separate HBAR thread. Anyone have any suggestions for places to get good information? I'd appreciate it, thank you!

IMO avoid all the smaller tokens, they are kinda like buying lottery tickets and in any market down turn those will hurt the most.

Read the white papers if you want the raw info.

FIFYBitcoin = Economic slavery, pore policy, and an insult to The Founding Fathers.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

FIFY

Thats called volatility and as the price of BTC increases and becomes more widespread the volatility naturally will decrease. Like all new products there is a period of price discovery. Cryptos are in that phase.

We know what it’s called and it’s just another sign of why it’s not currency and could never be used as such (as we both know).Thats called volatility and as the price of BTC increases and becomes more widespread the volatility naturally will decrease. Like all new products their is a period of price dscovery. Cryptos are in that phase.

Imagine if the Dollar lost 10% of its value in one day and what that would mean for the US and world economy.

We need to get real about this by recognizing how good we have it with the Dollar and lean into its value instead of creating shit products in search of a problem to solve.

We know what it’s called and it’s just another sign of why it’s not currency and could never be used as such (as we both know).

Imagine if the Dollar lost 10% of its value in one day and what that would mean for the US and world economy.

We need to get real about this by recognizing how good we have it with the Dollar and lean into its value instead of creating shit products in search of a problem to solve.

I don't think we are in search of a problem to solve, the problem is smacking us in the face. We have inflation the likes of which we haven't seen in close to 50 years. The government is printing money at a rate like never before. 40% of the total U.S. dollars ever created, have been created within the last 18 months. Inflation means that your store of value is worth less as time goes by. That doesn't sound like a great deal to me, I wan't the work i have previously done to be worth the same tomorrow as it is today, or at least as much as possible.

Thats what money is right? When we break it down to the basics you are exchanging your work or store of value for someones elses work or store of value.

As for your example, you say that "if the dollar lost 10% of its value in one day" .... inflation is the exact same thing as volatility of the dollar. Its no different than the price of bitcoin varying on a daily basis. Inflation is coming in at 6-7% a year.

Im not saying the dollar is a bad product or that it should disappear. I just think a digital payment system is probably the future and BTC and ETH are first to market so are most likely to succeed. Competition is almost always a good thing and there is room for both the dollar and Crypto. Just as there is the yen, ruble, peso, mark, remnibi, etc

No currency is not suppose to store value and never has been. It’s just supposed to not be volatile and have wild swings over short periods of time. Apparently you didn’t read my Ben Franklin thread because you would understand that inflation isn’t really a boogeyman either.I don't think we are in search of a problem to solve, the problem is smacking us in the face. We have inflation the likes of which we haven't seen in close to 50 years. The government is printing money at a rate like never before. 40% of the total U.S. dollars ever created, have been created within the last 18 months. Inflation means that your store of value is worth less as time goes by. That doesn't sound like a great deal to me, I wan't the work i have previously done to be worth the same tomorrow as it is today, or at least as much as possible.

Thats what money is right? When we break it down to the basics you are exchanging your work or store of value for someones elses work or store of value.

As for your example, you say that "if the dollar lost 10% of its value in one day" .... inflation is the exact same thing as volatility of the dollar. Its no different than the price of bitcoin varying on a daily basis. Inflation is coming in at 6-7% a year.

Im not saying the dollar is a bad product or that it should disappear. I just think a digital payment system is probably the future and BTC and ETH are first to market so are most likely to succeed. Competition is almost always a good thing and there is room for both the dollar and Crypto. Just as there is the yen, ruble, peso, mark, remnibi, etc

Benjamin Franklin’s Greatest Invention

Citizen Ben figured out how to make paper money as valuable as gold or silver coins—and got rich in the process.

On April 3, 1729, Franklin published a pamphlet with the falsely humble title A Modest Enquiry into the Nature and Necessity of a Paper Currency. It may be the least known of the great founding documents of the American experiment, but in it, he eviscerated his wealthy opponents. They had no real principle at stake, he wrote. Rather, they were greedy, relentlessly pursuing their own self-interest. The rich love currency crises because a lack of coins in circulation allows those who hold gold or silver to “practise Lending Money on Security for exorbitant Interest.” And, when times are tough, the wealthy can scoop up property at fire-sale prices. Without the trade that a robust money supply evokes, “the Common People in general will be impoverished, and consequently obliged to sell More Land for less Money than they will do at present.” Worse, Franklin predicted, when the land grab ends, those same purchasers will support expansion of the money supply, boosting the value of their new property.

Franklin argued that a well-run paper currency would ultimately benefit everyone: An adequate money supply lowers interest rates, encourages trade, creates more demand and raises the value of the colony’s products. He insisted that “labouring and Handicrafts Men (which are the chief Strength and Support of a People)” would move to Pennsylvania and those who were present would stay. Otherwise, skilled workers would seek “entertainment and Employment in other Places, where they can be better paid.”

Franklin simply made a pragmatic case: Paper money would solve the particular problem at hand. But what came next was his great revelation. How could paper currency ever be “real” money? Franklin’s answer was to recognize that money itself was simply a medium of exchange, a measure of value rather than its storehouse. Money allows the three pennies worth of bread Franklin bought on his first day in Philadelphia to become three pennies worth of laundering the baker needed done. The three coins Franklin handed to the baker served as a way of measuring how much the bread or the laundry was worth to each buyer and seller. Franklin argued that what was actually being exchanged was the work involved in making bread or washing clothes. That, and not the melted-down price to be had for the metal within the coins, gave the term “three pence” its true measure. Franklin concluded that money in circulation derived its value from the sum of all such transactions—all things made and all the services people exchange.

——————————————————

And no “competition” with The People’s will and choice of currency isn’t good. Every American should be doing everything in their power to build up the dollar as opposed to creating private products to undermine the sovereign will and rights of The American people.

Suggesting other sovereign currencies are the same as those private products isn’t accurate. Those currencies are the will and official tender of those sovereign peoples. The greatness and demand for the Dollar, as well as it being the world’s reserve, allows for conversion of those currencies while allowing the people of those countries to enact the monetary and economic policies they choose for themselves.

I’m the one who said currencies aren’t supposed to have volatile swings so yore making a pretty good case for me on why that level of volatility isn’t acceptable for functioning economies. Gonna show me stats from Venezuela and their dictators next?ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

A sovreign currency dropping 5% in minutes, how can it be?

I’m the one who said currencies aren’t supposed to have volatile swings so yore making a pretty good case for me on why that level of volatility isn’t acceptable for functioning economies. Gonna show me stats from Venezuela and their dictators next?

Im just saying any currency, private or sovereign, can be volatile.

And Donald Trump.

If Hillary and Trump both agree just imagine how terrible that actually is.

Bitcoin driving green energy innovation

just imagine how much energy could go to The People if we were wasting it on Bitcoin.

That’s the story of BTC tho: destruction, pain, and greed.

You left out Innovation.just imagine how much energy could go to The People if we were wasting it on Bitcoin.

That’s the story of BTC tho: destruction, pain, and greed.

The greatest financial innovation in our lifetime.

It’s regressive. We learned during The Great Depression why BTC could never work.You left out Innovation.

The greatest financial innovation in our lifetime.

Sup fam. Was working with a buddy to develop a token on Solana called LetsGoBrandon Token - $LGBT

Unfortunately someone beat us to it and released it about a week ago. Just posting this to give y’all a heads up in case you want to join in before it takes off

It’s a BSC token so it’s a available via PancakeSwap. You’ll have to copy/paste the contract address from CoinMarketCap or CoinGecko into Pancakeswap

Unfortunately someone beat us to it and released it about a week ago. Just posting this to give y’all a heads up in case you want to join in before it takes off

It’s a BSC token so it’s a available via PancakeSwap. You’ll have to copy/paste the contract address from CoinMarketCap or CoinGecko into Pancakeswap

The people of Turkey are getting the monetary policy their government established.

We should be praising that sorta system; Turkey gets to do what they want and the rest of us get to do what we want as sovereign countries.

No one world order, build back better, mark of the beast type shit like BTC and other cryptos.

A Sovreign currency experiencing volatility. (Don't worry that could never happen here,)

Bet those Turks wished they had bitcoin.

Bet those Turks wished they had bitcoin.

So, purchase Lira soon. Got it.A Sovreign currency experiencing volatility. (Don't worry that could never happen here,)

Bet those Turks wished they had bitcoin.

View attachment 62822

Similar threads

- Replies

- 11

- Views

- 422

- Replies

- 48

- Views

- 1K

- Replies

- 6

- Views

- 166

- Replies

- 7

- Views

- 286

Support Free Speech

- Current cycle

- $1.00

- Total amount

- $623.00