After graduating from Stanford Law School, Thiel clerked for Judge James Larry Edmondson of the United States Court of Appeals for the 11th Circuit.

Thiel then worked as a securities lawyer for Sullivan & Cromwell in New York.

He left the law firm in under a year.

He then took a job as a derivatives trader in currency options at Credit Suisse in 1993 while also working as a speechwriter for former United States Secretary of Education William Bennett. Thiel returned to California in 1996.

Upon returning to the Bay Area, Thiel capitalized on the dot-com boom.

With financial support from friends and family, he raised $1 million toward the establishment of Thiel Capital Management and embarked on his venture capital career.

Early on, he experienced a setback after investing $100,000 in his friend Luke Nosek's unsuccessful web-based calendar project.

Soon thereafter, Nosek's friend Max Levchin described to Thiel his cryptography-related company idea, which became their first venture called Fieldlink (later renamed Confinity) in 1998.

PayPal

With Confinity, Thiel realized they could develop software to bridge a gap in making online payments.

Although the use of credit cards and expanding automated teller machine networks provided consumers with more payment options, not all merchants had the necessary hardware to accept credit cards.

Thus, consumers had to pay with exact cash or check.

Thiel wanted to create a type of digital wallet for consumer convenience and security by encrypting data on digital devices, and in 1999 Confinity launched PayPal.

When PayPal launched at a press conference in 1999, representatives from Nokia and Deutsche Bank sent $3 million in venture funding to Thiel using PayPal on their PalmPilots.

PayPal then continued to grow through mergers in 2000 with Elon Musk's online financial services company X.com, and with Pixo, a company specializing in mobile commerce.

These mergers allowed PayPal to expand into the wireless phone market and transformed it into a safer and more user-friendly tool by enabling users to transfer money via a free online registration and email rather than by exchanging bank account information. PayPal went public on 15 February 2002 and was bought by eBay for $1.5 billion in October of that year.

Thiel remained CEO of the company until the sale.

His 3.7% stake in the company was worth $55 million at the time of acquisition.

In Silicon Valley circles, Thiel is colloquially referred to as the "Don of the PayPal Mafia".

Clarium Capital

Further information: Clarium Capital

Thiel used $10 million of his proceeds to create Clarium Capital Management, a global macro hedge fund focusing on directional and liquid instruments in currencies, interest rates, commodities, and equities.

Thiel stated that "the big, macroeconomic idea that we had at Clarium—the idée fixe—was the peak-oil theory, which was basically that the world was running out of oil, and that there were no easy alternatives."

In 2003, Thiel successfully bet that the United States dollar would weaken.

In 2004, Thiel spoke of the dot-com bubble having migrated, in effect, into a growing bubble in the financial sector, and specified General Electric and Walmart as vulnerable.

In 2005, Clarium saw a 57.1% return as Thiel predicted that the dollar would rally.

However, Clarium faltered in 2006 with a 7.8% loss.

Thereafter, the firm sought to profit in the long-term from its petrodollar analysis, which foresaw the impending decline in oil supplies.

Clarium's assets under management grew after achieving a 40.3% return in 2007 to more than $7 billion by the first quarter of 2008, but fell later in the year and again in 2009 after financial markets collapsed.

By 2011, after missing out on the economic rebound, many key investors pulled out, reducing the value of Clarium's assets to $350 million, two thirds of which was Thiel's money.

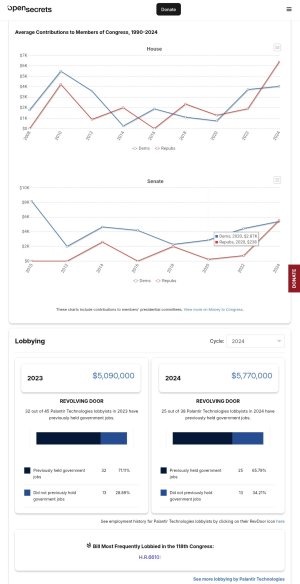

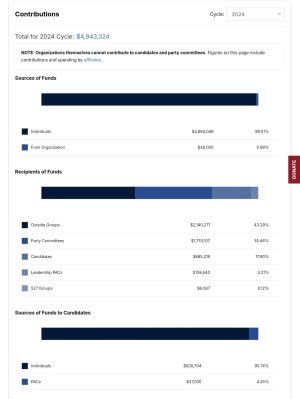

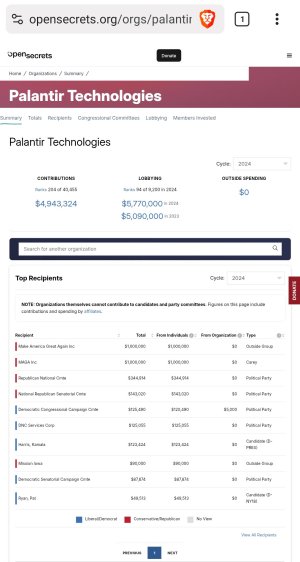

Palantir

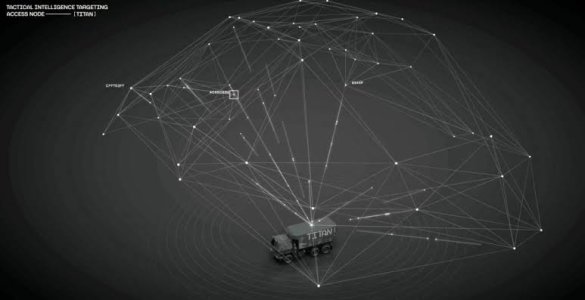

In May 2003, Thiel incorporated Palantir Technologies, a big data analysis company named after the Tolkien artifact.

He continues as its chairman, as of 2022.

Thiel stated that the idea for the company was based on the realization that "the approaches that PayPal had used to fight fraud could be extended into other contexts, like fighting terrorism".

He also stated that, after the September 11 attacks, the debate in the United States was "will we have more security with less privacy or less security with more privacy?".

He envisioned Palantir as providing data mining services to government intelligence agencies that were maximally unintrusive and traceable.

Palantir's first backer was the Central Intelligence Agency's venture capital arm In-Q-Tel.

The company steadily grew and in 2015 was valued at $20 billion, with Thiel being the company's largest shareholder.

Facebook

In August 2004, Thiel made a $500,000 angel investment in Facebook for a 10.2% stake in the company and joined Facebook's board.

This was the first outside investment in Facebook and valued the company at $4.9 million.

As a board member, Thiel was not actively involved in Facebook's operations.

He provided help with timing the various rounds of funding and Zuckerberg credited Thiel with helping him time Facebook's 2007 Series D, which closed before the 2008 financial crisis.

In his book The Facebook Effect, David Kirkpatrick outlines how Thiel came to make this investment: Napster co-founder Sean Parker, who at the time had assumed the title of "President" of Facebook, was seeking investors. Parker approached Reid Hoffman, the CEO of work-based social network LinkedIn.

Hoffman liked Facebook but declined to become lead investor because of the potential for conflict of interest.

Hoffman directed Parker to Thiel, whom he knew from their PayPal days.

Thiel met Parker and Facebook founder Mark Zuckerberg.

Thiel and Zuckerberg got along well, and Thiel agreed to lead Facebook's seed round with $500,000 for 10.2% of the company.

The investment was originally in the form of a convertible note, to be converted to equity if Facebook reached 1.5 million users by the end of 2004.

Although Facebook narrowly missed the target, Thiel allowed the loan to be converted to equity anyway.

Thiel said of his investment: "I was comfortable with them pursuing their original vision.

And it was a very reasonable valuation. I thought it was going to be a pretty safe investment."

In September 2010, Thiel, while expressing skepticism about the potential for growth in the consumer Internet sector, argued that relative to other Internet companies, Facebook (which then had a secondary market valuation of $30 billion) was comparatively undervalued.

Facebook's initial public offering was in May 2012, with a market cap of nearly $100 billion ($38 a share), at which time Thiel sold 16.8 million shares for $638 million.

In August 2012, immediately upon the conclusion of the early investor lock-up period, Thiel sold almost all of his remaining stake for between $19.27 and $20.69 per share, or $395.8 million, for a total of more than $1 billion.

He retained his seat on the board of directors.

In 2016, he sold a little under 1 million of his shares for around $100 million.

In November 2017, he sold another 160,805 shares for $29 million, putting his holdings in Facebook at 59,913 Class A shares.

As of April 2020, he owned less than 10,000 shares in Facebook.

On 7 February 2022, Thiel announced he would not stand for re-election to the board of Facebook owner Meta at the 2022 annual stockholders' meeting and would leave after 17 years in order to support pro–Donald Trump candidates in the 2022 United States elections.

Founders Fund

In 2005, Thiel created Founders Fund, a San Francisco-based venture capital fund.

Other partners in the fund include Sean Parker, Ken Howery, and Luke Nosek.

The Fund focuses on defense-related startups and technology.

The Economist notes that the Fund and Thiel, personally, have a history of incubating startups that do hypersensitive work related to national security.

The Fund casts Palantir, Anduril and the newly-minted nuclear startup General Matter as the three parts of a trilogy, to which it hopes to add others, among which a plan for onshoring ultraviolet light lithography.

Business Insider reports that, among Thiel's inner circle (who know well the billionaire's fondness for Tolkien's works), the Fund is nicknamed "the Precious", in reference to the One Ring of Sauron.

In addition to Facebook, Thiel made early-stage investments in numerous startups (personally or through Founders Fund), including Airbnb, Slide.com, LinkedIn, Friendster, RapLeaf, Geni.com, Yammer, Yelp Inc., Spotify, Powerset, Practice Fusion, MetaMed, Vator, SpaceX, IronPort, Votizen, Asana, Big Think, CapLinked, Quora, Nanotronics Imaging, Rypple, TransferWise, Stripe, Block.one, and AltSchool.

Thiel also backed DeepMind, a UK start-up that was acquired by Google in early 2014 for £400 million.

In 2017, Founders Fund bought about $15–20 million worth of bitcoin.

In January 2018, the firm told investors that due to the cryptocurrency's surge the holdings were worth hundreds of millions of dollars.

Also in 2017, Thiel was one of the first outside investors in Clearview AI, a facial recognition technology startup that has raised concerns in the tech world and media for its risks of weaponization.

Valar Ventures

Through Valar Ventures, an internationally focused venture firm he cofounded with Andrew McCormack and James Fitzgerald, Thiel was an early investor in Xero, a software firm headquartered in New Zealand.

Valar Ventures also invested in New Zealand-based companies Pacific Fibre and Booktrack.

Mithril Capital

In June 2012, he launched Mithril Capital Management, named after the fictitious metal in The Lord of the Rings, with Jim O'Neill and Ajay Royan.

Unlike Clarium Capital, Mithril Capital, a fund with $402 million at the time of launch, targets companies that are beyond the startup stage and ready to scale up.

Y Combinator

In March 2015, Thiel joined Y Combinator as one of 10 part-time partners.

In November 2017, it was reported that Y Combinator had severed its ties with Thiel.

Business Insider reported that Thiel became an FBI informant in 2021.

America’s Frontier Fund

Thiel is the co-founder of America’s Frontier Fund, together with Eric Schmidt.

The New York Times writes that, America’s Frontier Fund is an organization committed to bring manufacturing back to the US, especially that of semiconductors, and the leaders are determinded to carry out this mission whether the state helps them or not.

Influence Watch notes the fund's bipartisan character, with the participation of Ashton B. Carter and H.R. McMaster and the fact that the two founders are left and right-of-center respectively.

The chief executive is Gilman Louie.

Rivada Space Networks

Around the early 2020s, the Bavarian startup Kleo-Connect successfully developed a highly advanced satellite technology, which is considered much more suitable for governmental and military use than that of Starlink, which was originally conceived for civilian use only.

It was feared the technology would fall into the hand of the PLA through its Chinese investors (who invested in the startup since 2018) though.

Thus, the German government banned the sale of the company to China, but 144 lawsuits worldwide deterred investors from helping the company to expand the constellation.

The founders decided to bring in the US's " highest conservative circles" (which led to the formation of Rivada Space Networks, which drew its personnel mainly from Kleo-Connect, in 2022), among which Karl Rove participated as an investor and lobbyist, and former US Security of State Mike Pompeo joined the board of the mother company in the US, alongside others like Richard Myers, Jeb Bush, James Loy, Lord Guthrie and the Democrat Martin O’Malley.

Rivada Networks's chairman Declan Ganley notes in particular the power of Thiel's name (whose investment in the firm remains undisclosed) in negotiation with investors.

The United States Department of Defense is also an investor.

Newt Gingrich is noted to have lobbied for the firm too.

By 2025, the "politically connected company" has already expanded to 33 countries and collected 16 billion dollars in investments, despite having not launched its satellites (deployment is set to begin in 2027 with initial tests set for 2026).

Thiel reportedly works to help the company's development, especially regarding its legal battles.

Enhanced Games

In 2024, Thiel became one of the investors in the Enhanced Games, a proposed multi-sport event that will allow athletes to use performance-enhancing substances without being subject to drug tests.