So what actually happens when the Yaun replaces the Dollar as the back for oil. Do we crash horrifically and go away, or do we just become England in the long run. I hate being second fiddle to anyone, but part of me likes the fact that maybe with our Dollar not being the major force in the world, American men can come home and defend our country and we can get back to isolationism. Let China be the world policeman.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Fall of dollar

- Thread starter skramer100

- Start date

This is a great question. Our whole lives we have lived under a "king dollar" world but that seems to be changing before our eyes (thanks sleepy joe, you pathetic piece of shit.)

Knot gonna happen sew know knead two even worry about it. Saudi threatens this every thyme they get jobbed. Only 80% is priced in Dollars anywheys.

www.wsj.com

www.wsj.com

“A senior U.S. official called the idea of the Saudis selling oil to China in yuan “highly volatile and aggressive” and “not very likely.” The official said the Saudis had floated the idea in the past when there was tension between Washington and Riyadh.

It is possible the Saudis could back off. Switching millions of barrels of oil trades from dollars to yuan every day could rattle the Saudi economy, which has a currency, the riyal, pegged to the dollar. Prince Mohammed’s aides have been warning him of unpredictable economic damage if he moves ahead with the plan hastily.”

Even if it did happen it woodnt bee a big deal. Dollars Will always bee king.

WSJ News Exclusive | Saudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil Sales

Saudi Arabia is in active talks with Beijing to price its oil sales to China in yuan, people familiar with the matter said, a move that would dent the U.S. dollar’s dominance of the global petroleum market and mark another shift by the world’s top crude exporter toward Asia.

“A senior U.S. official called the idea of the Saudis selling oil to China in yuan “highly volatile and aggressive” and “not very likely.” The official said the Saudis had floated the idea in the past when there was tension between Washington and Riyadh.

It is possible the Saudis could back off. Switching millions of barrels of oil trades from dollars to yuan every day could rattle the Saudi economy, which has a currency, the riyal, pegged to the dollar. Prince Mohammed’s aides have been warning him of unpredictable economic damage if he moves ahead with the plan hastily.”

Even if it did happen it woodnt bee a big deal. Dollars Will always bee king.

Last edited:

I honestly think if it happens now is the time for it to happen. Biden is an idiot, and our Speaker just quoted a 3 line poem from a U2 singer. We are weak AF right now. I honestly just want opinions on what could happen if we fall, not misspelled words and love of Fauci and Trump.

BigBucnNole

Elite

6 to 7 trillion in USD equivalent dollars are traded daily on FX markets. 85% of that is US dollars, anyone that thinks a currency where the GDP per capita is maybe $10k is capable of replacing the dollar is out of their mind or terribly uninformed.Thats not even factoring in the manipulation that goes into the Yuan.

Correct6 to 7 trillion in USD equivalent dollars are traded daily on FX markets. 85% of that is US dollars, anyone that thinks a currency where the GDP per capita is maybe $10k is capable of replacing the dollar is out of their mind or terribly uninformed.Thats not even factoring in the manipulation that goes into the Yuan.

6 to 7 trillion in USD equivalent dollars are traded daily on FX markets. 85% of that is US dollars, anyone that thinks a currency where the GDP per capita is maybe $10k is capable of replacing the dollar is out of their mind or terribly uninformed. Thats not even factoring in the manipulation that goes into the Yuan.

Fair point.

Fair point, but if we are not backed by oil can we stay in power. I mean all this shit is going down and our House passes a bill about hair discrimination?6 to 7 trillion in USD equivalent dollars are traded daily on FX markets. 85% of that is US dollars, anyone that thinks a currency where the GDP per capita is maybe $10k is capable of replacing the dollar is out of their mind or terribly uninformed.Thats not even factoring in the manipulation that goes into the Yuan.

BigBucnNole

Elite

Fair point, but if we are not backed by oil can we stay in power. I mean all this shit is going down and our House passes a bill about hair discrimination?

Demand for it is partially driven by oil, but the US is a huge advanced and fully developed economy. We're surrounded by oceans with nothing to threaten us directly. We have one of the largest navigable internal river systems in the world that feed straight to natural harbors. That allows us to develop manufactured goods and/ or raw material and quickly push it to market at low cost. Our geographic advantages mean this part of the planet will always be a powerful economic engine and a good place to stash your money.

The only currency remotely capable of supplanting the dollar might be the Euro. But the Euro central banking system is a collective of rich and poor economies. The Germans like it to a degree that shitty economies, like Greece, can afford the currency to purchase goods and leverage debt, but at the same time, the Germans/ advanced European economies have to shoulder the cost of rising exchange rates when the poorer economies like Spain, Italy, or Greece overextend themselves. That builds an inherent risk the dollar doesn't have on a grand scale.

A shitty policy can cause issues, no denying that here, but there is no viable alternative. Even the crypto stuff while a cool idea isn't saddled with the backing of an advanced mega economy. Furthermore, the largest purchaser of US debt is the US government through intragovernmental lending. The bulk of the debt is held by individual investors and banks, most being American. And that's always going to be the case because the dollar, as the world's reserve, is going to be something you want to have on hand in dealing in international transactions.

The oil argument is like an extra buffer to the USD. When you dive into the FX markets, 95% of that 6 to 7 trillion is tied to banks basically purchasing and selling currency to acquire something or making investments. Oil, even at 40 million barrels consumed daily across the planet, is $4 billion dollars daily.

Demand for it is partially driven by oil, but the US is a huge advanced and fully developed economy. We're surrounded by oceans with nothing to threaten us directly. We have one of the largest navigable internal river systems in the world that feed straight to natural harbors. That allows us to develop manufactured goods and/ or raw material and quickly push it to market at low cost. Our geographic advantages mean this part of the planet will always be a powerful economic engine and a good place to stash your money.

The only currency remotely capable of supplanting the dollar might be the Euro. But the Euro central banking system is a collective of rich and poor economies. The Germans like it to a degree that shitty economies, like Greece, can afford the currency to purchase goods and leverage debt, but at the same time, the Germans/ advanced European economies have to shoulder the cost of rising exchange rates when the poorer economies like Spain, Italy, or Greece overextend themselves. That builds an inherent risk the dollar doesn't have on a grand scale.

A shitty policy can cause issues, no denying that here, but there is no viable alternative. Even the crypto stuff while a cool idea isn't saddled with the backing of an advanced mega economy. Furthermore, the largest purchaser of US debt is the US government through intragovernmental lending. The bulk of the debt is held by individual investors and banks, most being American. And that's always going to be the case because the dollar, as the world's reserve, is going to be something you want to have on hand in dealing in international transactions.

The oil argument is like an extra buffer to the USD. When you dive into the FX markets, 95% of that 6 to 7 trillion is tied to banks basically purchasing and selling currency to acquire something or making investments. Oil, even at 40 million barrels consumed daily across the planet, is $4 billion dollars daily.

If SA, Iran, Venezuela and Russia all decide to stick it to the US because of our meddling over the decades.... they can fuck the hell out of us. Glen Beck had an economist on that said the impact would be soooo bad he doesn't think China would do it because it would lead to a world depression and they are still trying to grow. Now, he did say that they could stick it to us in other ways especially by selling our bonds and getting rid of a ton of US dollars. Russia dealing direct with China would still allow the world to suffer slow instead of catastrophic fall.

@BigBucnNole

www.zerohedge.com

www.zerohedge.com

What happens when the USD is no longer considered a risk-free asset? Almost all portfolio management and financial business decisions are based off of financial modeling including a risk-free rate.

I agree with this guy. BTC will one day take over the dollar as the worlds reserve currency. The trust has been broken between the government and the governed and personally i think its broken beyond repair.

It will be a slow process 10, 20, 30 years or even longer, but I just don't see how it doesn't happen. To be clear the BTC mechanics could not handle a transition overnight it needs years to slowly build out much like the world could not handle a switch from gas to electric cars over night.

"The Risk now is of being unaware that the monetary regime that has been in place for the past fifty years just ended."

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

What happens when the USD is no longer considered a risk-free asset? Almost all portfolio management and financial business decisions are based off of financial modeling including a risk-free rate.

I agree with this guy. BTC will one day take over the dollar as the worlds reserve currency. The trust has been broken between the government and the governed and personally i think its broken beyond repair.

It will be a slow process 10, 20, 30 years or even longer, but I just don't see how it doesn't happen. To be clear the BTC mechanics could not handle a transition overnight it needs years to slowly build out much like the world could not handle a switch from gas to electric cars over night.

"The Risk now is of being unaware that the monetary regime that has been in place for the past fifty years just ended."

BigBucnNole

Elite

@BigBucnNole

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

What happens when the USD is no longer considered a risk-free asset? Almost all portfolio management and financial business decisions are based off of financial modeling including a risk-free rate.

I agree with this guy. BTC will one day take over the dollar as the worlds reserve currency. The trust has been broken between the government and the governed and personally i think its broken beyond repair.

It will be a slow process 10, 20, 30 years or even longer, but I just don't see how it doesn't happen. To be clear the BTC mechanics could not handle a transition overnight it needs years to slowly build out much like the world could not handle a switch from gas to electric cars over night.

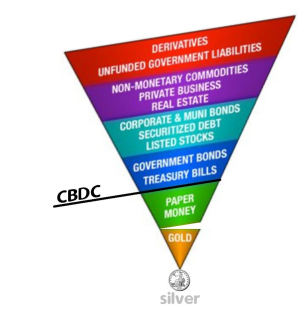

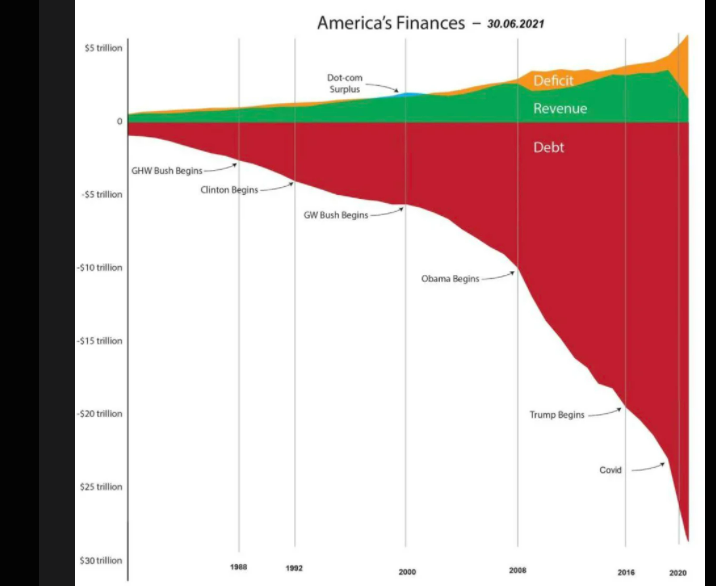

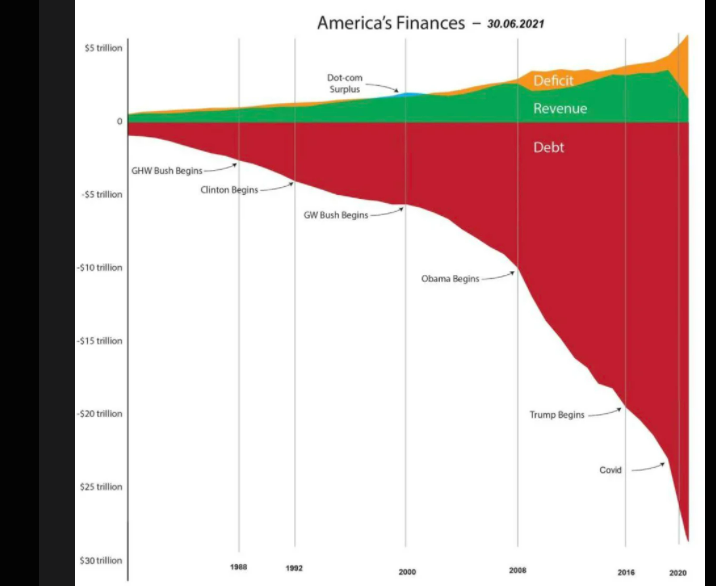

View attachment 86968

"The Risk now is of being unaware that the monetary regime that has been in place for the past fifty years just ended."

View attachment 86978

View attachment 86982

View attachment 86983

Meh, zero hedge is a bit sensationalist for my taste.

All trust means for currency is whether or not this vehicle or that vehicle is a consistent store of value. Problem with bitcoin is that it's idealistic. It's value in the last year had a 25% devaluation, and then went up 20%. How is that a consistent store of value? The other problem is it's capped and economies outgrow the increase in bitcoins.

That's a big deal because it creates deflationary pressure. Deflation is 100x worse than inflation. You can always increase rates to control inflation. Flipside, once rates hit zero to control deflation, there is a point it doesn't make sense to go negative which triggers your deflationary spiral. The Great Depression was caused by deflation and it took a World War to break the cycle.

Meh, zero hedge is a bit sensationalist for my taste.

All trust means for currency is whether or not this vehicle or that vehicle is a consistent store of value. Problem with bitcoin is that it's idealistic. It's value in the last year had a 25% devaluation, and then went up 20%. How is that a consistent store of value? The other problem is it's capped and economies outgrow the increase in bitcoins.

That's a big deal because it creates deflationary pressure. Deflation is 100x worse than inflation. You can always increase rates to control inflation. Flipside, once rates hit zero to control deflation, there is a point it doesn't make sense to go negative which triggers your deflationary spiral. The Great Depression was caused by deflation and it took a World War to break the cycle.

Eye trust yew, the individual citizen, far less than eye trust the government (and eye don’t trust the government at all).@BigBucnNole

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

What happens when the USD is no longer considered a risk-free asset? Almost all portfolio management and financial business decisions are based off of financial modeling including a risk-free rate.

I agree with this guy. BTC will one day take over the dollar as the worlds reserve currency. The trust has been broken between the government and the governed and personally i think its broken beyond repair.

It will be a slow process 10, 20, 30 years or even longer, but I just don't see how it doesn't happen. To be clear the BTC mechanics could not handle a transition overnight it needs years to slowly build out much like the world could not handle a switch from gas to electric cars over night.

View attachment 86968

"The Risk now is of being unaware that the monetary regime that has been in place for the past fifty years just ended."

View attachment 86978

View attachment 86982

View attachment 86983

Eye have even less trust in foreigners (who wood also hold BTC inn yore future).

BTC is less trust if yore aiming four Moore trust.

That’s knot even accounting four everything he just pointed out (like I’ve told yew and others befour) along the national security & and privacy problems it creates.

BigBucnNole

Elite

Jmo, if the dollar falls it will also kill all the other fiat currencies along with it.

China is just as leveraged as we are

China's debt is different too. China has corporate debt equaling 200% GDP. Adding in public debt, it's close to 250%. We're around 100%.

A lot of the Chinese debt is non performing. We do not have that issue.

TTUcamper

Elite

China's debt is different too. China has corporate debt equaling 200% GDP. Adding in public debt, it's close to 250%. We're around 100%.

A lot of the Chinese debt is non performing. We do not have that issue.

Part of me wonders if the Chinese and us both realize our currencies need to die and are just trying to manipulate the fall in a way that favors certain countries/entities the most.

Policies on spending around the world have been so inflationary it looks purposeful. You are seeing a ton of "steal as much fiat as you can and turn it into commodities" by a lot of folks, especially in the billionaire community

Feb. 26th will go down in history as the day the Dollar died. Sanctions on f/x reserves from the world's reserve currency combined with negative real rates on US treasuries killed it. More trade will be done in Yuan going forward, but the main thing to watch for is foreign central banks will start loading up on gold.So what actually happens when the Yaun replaces the Dollar as the back for oil. Do we crash horrifically and go away, or do we just become England in the long run. I hate being second fiddle to anyone, but part of me likes the fact that maybe with our Dollar not being the major force in the world, American men can come home and defend our country and we can get back to isolationism. Let China be the world policeman.

Last edited:

BigBucnNole

Elite

Feb. 26th will go down in history as the day the Dollar died. Sanctions on f/x reservers from the world's reserve currency combined with negative real rates on US treasuries killed it. More trade will be done in Yuan going forward, but the main thing to watch for is foreign central banks will start loading up on gold.

Yuan represents about 4% of FX turnover. USD's are 88.5%. Try again.

No one is arguing its going to happen overnight. You are confident a switch to the yuan won't happen overnight, so am i. How confident are you that the dollar is still king in say 25 years?Yuan represents about 4% of FX turnover. USD's are 88.5%. Try again.

BigBucnNole

Elite

No one is arguing its going to happen overnight. You are confident a switch to the yuan won't happen overnight, so am i. How confident are you that the dollar is still king in say 25 years?

Extremely. US is the only advanced economy that will be growing in population. Projected to hit 425 to 450 million by 2050. Most countries will be stagnating or declining and overwhelmed by the cost of too many old people.

Unless WW3 breaks out, the entire developed world minus the US is set for a demographic population bomb.

Odds are the US is looking at a golden age in the next two decades

Yup. The US is going two continue two pull away Fromm the pack.Extremely. US is the only advanced economy that will be growing in population. Projected to hit 425 to 450 million by 2050. Most countries will be stagnating or declining and overwhelmed by the cost of too many old people.

Unless WW3 breaks out, the entire developed world minus the US is set for a demographic population bomb.

Odds are the US is looking at a golden age in the next two decades

Extremely. US is the only advanced economy that will be growing in population. Projected to hit 425 to 450 million by 2050. Most countries will be stagnating or declining and overwhelmed by the cost of too many old people.

Unless WW3 breaks out, the entire developed world minus the US is set for a demographic population bomb.

Odds are the US is looking at a golden age in the next two decades

Joe King

Elite

One of the things that would happen is that If all the dollars held around the World are no longer needed for trade or as reserves, they'll all come flooding home to America by buying up everything here that isn't nailed down.I honestly just want opinions on what could happen if we fall, not misspelled words

How'd I do on spelling?

It's called a normalcy bias that many seeingly are afflicted with.When I hear people glorify the dollar, I can't help but think about the Titanic. Unsinkable!

MalO

Elite

The Fed only has itself to blame. They permitted too much inflation for too long, and now this is the result.

Expect more countries to follow Russia and stop using the dollar.

www.yahoo.com

www.yahoo.com

Expect more countries to follow Russia and stop using the dollar.

Putin is strengthening the yuan’s role as Russia’s foreign currency of choice

For his nation’s businesses in the global market, Russian president Vladimir Putin endorsed the yuan as the currency of choice on the second day of Chinese president Xi Jinping’s visit to Moscow.

This is what I'm thinking. People that think China has to use our dollar because we are the biggest economy aren't considering that if China helps the 3rd world crawl out of poverty and has preferred trade deals with those developing countries... they can replace the US in 10 years. They can slowly wean off the US as they make themselves stronger and we continue to weaken our country with crazy/stupid politicians and bureaucrats worrying only about themselves.

How did the US become the greatest economy in the world? Wasn't it by a huge industrial base and global trade? Isn't that exactly what China is attempting to do?

Joe King

Elite

Yes, that is exactly what they are doing.How did the US become the greatest economy in the world? Wasn't it by a huge industrial base and global trade? Isn't that exactly what China is attempting to do?

I saw a map awhile back that showed the nations of the World by their primary trading partner. Twenty years ago it showed almost all nations as having the US as their primary trading partner. Today, almost every nation's primary trading partner is China.

Couldn't find the exact one, but this one tells the story.

Goldhedge

Legendary

The world is tired of being abused by the dollar

Saudi Arabia, the UAE, Algeria, Egypt, Bahrain, and Iran have formally asked to join the BRICS group of nations as it prepares to hold its annual summit in South Africa.

In total, 19 nations have expressed interest in joining the emerging-markets bloc of Brazil, Russia, India, China, and South Africa, according to Anil Sooklal, South Africa’s ambassador to the group.

Earlier this month, Bloomberg revealed that BRICS is expected to soon surpass the US-led G7 states in economic growth expectations.

Per their analysis, while G7 and BRICS nations each contributed equally to global economic growth in 2020, the western-led bloc’s performance has recently declined. By 2028, the G7 is expected to make up just 27.8 percent of the global economy, while BRICS will make up 35 percent.

The estimations came just a few weeks after the Deputy Chairman of Russia’s State Duma, Alexander Babakov, revealed that BRICS is working on developing a “new currency” that will be presented at the organization’s upcoming summit.

BRICS member states account for over 40 percent of the global population and around a quarter of the global GDP.

The interest from Global South nations to join the bloc comes at a time when more and more governments move away from the US dollar.

The greenback has become more unreliable for dollarized economies due to rising interest rates regulated by the US Federal Reserve (FED) and the bank’s weaponization of the dollar through financial sanctions.

In addition, the west – especially Europe – is facing a growing energy crisis resulting from sanctions targeting Russian energy markets due to its invasion of Ukraine and the US sabotage of the Nordstream pipeline.

www.zerohedge.com

www.zerohedge.com

Five Arab States Plus Iran Among 19 Nations Ready To Join BRICS

Via The Cradle,Saudi Arabia, the UAE, Algeria, Egypt, Bahrain, and Iran have formally asked to join the BRICS group of nations as it prepares to hold its annual summit in South Africa.

In total, 19 nations have expressed interest in joining the emerging-markets bloc of Brazil, Russia, India, China, and South Africa, according to Anil Sooklal, South Africa’s ambassador to the group.

BRICS will hold its annual summit in Cape Town during the first week of June. The foreign ministers from all five member states have confirmed their attendance.“What will be discussed is the expansion of BRICS and the modalities of how this will happen... Thirteen countries have formally asked to join, and another six have asked informally. We are getting applications to join every day,” the South African official told Bloomberg earlier this week.

Earlier this month, Bloomberg revealed that BRICS is expected to soon surpass the US-led G7 states in economic growth expectations.

Per their analysis, while G7 and BRICS nations each contributed equally to global economic growth in 2020, the western-led bloc’s performance has recently declined. By 2028, the G7 is expected to make up just 27.8 percent of the global economy, while BRICS will make up 35 percent.

The estimations came just a few weeks after the Deputy Chairman of Russia’s State Duma, Alexander Babakov, revealed that BRICS is working on developing a “new currency” that will be presented at the organization’s upcoming summit.

BRICS member states account for over 40 percent of the global population and around a quarter of the global GDP.

The interest from Global South nations to join the bloc comes at a time when more and more governments move away from the US dollar.

The greenback has become more unreliable for dollarized economies due to rising interest rates regulated by the US Federal Reserve (FED) and the bank’s weaponization of the dollar through financial sanctions.

In addition, the west – especially Europe – is facing a growing energy crisis resulting from sanctions targeting Russian energy markets due to its invasion of Ukraine and the US sabotage of the Nordstream pipeline.

Five Arab States Plus Iran Among 19 Nations Ready To Join BRICS | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

LOL. What is that 85% at now?6 to 7 trillion in USD equivalent dollars are traded daily on FX markets. 85% of that is US dollars, anyone that thinks a currency where the GDP per capita is maybe $10k is capable of replacing the dollar is out of their mind or terribly uninformed.Thats not even factoring in the manipulation that goes into the Yuan.

BigBucnNole

Elite

LOL. What is that 85% at now?

88%

Similar threads

- Replies

- 1

- Views

- 70

- Replies

- 2

- Views

- 213

- Replies

- 12

- Views

- 688