You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Master Dance Your Cares Away/Fraggle/Law Abiding Citizens

- Thread starter Bryan74b

- Start date

Community megathread

I was there 2 weeks ago. The freaks have taken over Chelsea, SoHo, and the financial district. Normal isn’t normal there. Sad what’s happened.I will not be traveling to NYC again any time soon.

So far it doesn’t mean much.What the freak does this mean?

SECRET SILVER REFINERY SHORTAGE EXPOSED!  Dealer Reveals Shocking Reason NO ONE KNOWS ABOUT!

Dealer Reveals Shocking Reason NO ONE KNOWS ABOUT!

In this video my bullion dealer Silver Dave of Local Silver Mint reveals the shocking silver refinery shortage that no one is talking about! Why are silver refineries refusing 90% silver, sterling silver, and other alloyed silver? How does the military's need for silver factor in? And what does this silver shortage mean to the future price of silver? Watch as Silver Dave and vocal silver buyers in his shot share their thoughts on what's coming with stacking silver and gold and the best exit strategy to have with one's bullion. Are YOU about to sell your silver or gold back to a bullion dealer? Join Silver Dave and I as we dive DEEP into what REALLY happening at the silver refineries and why! Never before has stacking precious metals been as important to do as it is today. Protect yourself from out-of-control governments, evil central banks, and the failing US dollar's grip as the world's reserve currency. Make sure you build a stack of silver rounds, silver bars, silver coins, and gold coins as essential barter and wealth preservation!It’s on Josh Howerton’s Facebook page.Is this on any other platform? Instagram won’t play

1K views | Josh Howerton - The Apostle Paul issued this warning to Christians in the book of Galatians... | Carolyn A. Walton Rockey

Josh Howerton - The Apostle Paul issued this warning to Christians in the book of Galatians...

www.facebook.com

www.facebook.com

Supposedly they followed the bomber to a parking lot and noted the car they entered and then stopped the investigation. Curious if that "whistleblower" was accurate on that. If they walked away from investigating a crime like that then that seems criminal in itself.

On Wednesday night, FDNY members responded to multiple calls for a fire at 955 Westchester Avenue in the Bronx. Firefighters arrived to find multiple cars and rubbish piles on fire. While on scene, an explosion occurred injuring seven firefighters. “The explosion injured seven firefighters, five of them with burns to the hands and the face. Three of them are being admitted. The burns are considered serious, but non-life threatening. Our firefighters are awake, alert and speaking, but they have some serious burns, and we'll be praying for them. With quick action by our Emergency Medical Service, they were transported to Jacobi Hospital, where they were given great care by Jacobi Hospital emergency personnel in the trauma and burn center,” said Chief of Department John Esposito. FDNY Fire Marshals are working to determine the cause of the fire.

ed light flashing in the banking sector dashboard.

The banks are playing musical chairs and the music is about to stop.

Did you hear what the FED just did?

“In the middle of the night, while most Americans were asleep, the Federal Reserve injected $29.4 billion into the U.S. banking system. It was a “repo operation” — short for repurchase agreement — a mechanism the Fed uses to lend cash to banks in exchange for collateral, usually Treasury securities. The move didn’t make mainstream headlines, but it sent ripples through financial circles. A sudden infusion of this size often signals acute liquidity stress, the kind that central banks are usually desperate to conceal.

The question is: why now?”

The FED just “quietly” injected almost $30 billion of liquidity into the banking system.

The biggest injection since 2020, when the world economy was shut down because of Covid.

Nothing to see here folks!

“The last time the Fed intervened so aggressively in repo markets was September 2019. Then, overnight lending rates between banks suddenly spiked from around 2% to as high as 10%, freezing the interbank market and forcing the Fed to inject hundreds of billions in the months leading up to the pandemic. At the time, officials claimed it was merely a “technical adjustment.” Within months, COVID-19 hit, and the Fed began printing trillions.

The parallels today are hard to ignore. The Fed insists the financial system is “resilient,” yet liquidity injections of this magnitude tell a different story. A healthy banking system doesn’t need an emergency $29 billion cash bath in the middle of the night.”

When “lending rates” spike between banks, there is a massive problem.

Banks don’t want to “lend” their cash to other banks.

Why?

There is actually a shortage of “real dollars.”

They are all afraid to be short “real dollars” if another banking run begins.

A game of musical chairs and the FED is desperately trying to keep the music playing.

“Officially, repo operations are described as part of “routine monetary management.” But $29.4 billion isn’t routine. The Fed’s own balance sheet data shows that such injections often occur when institutions are short on cash or collateral — in other words, when confidence is eroding.”

But remember, this isn’t just a problem with the banking system in America.

The U.S. is the world’s reserve currency.

The FED is the most powerful central bank in the world and they have bailed out several prominent central banks since the beginning of Trump’s first term, such as the central banks of the U.K., Switzerland and Japan.

If the banking system is in trouble in America, then the banking system worldwide is in trouble.

“There’s another layer to this story — one that rarely reaches public discourse. Global liquidity has been deteriorating. Japan’s yen is collapsing, European banks are strained by energy and debt costs, and China’s property bubble continues to deflate. The dollar’s strength, ironically, creates weakness elsewhere. When global institutions face dollar shortages, they sell Treasuries to raise cash, driving yields higher and putting even more stress on U.S. banks holding those bonds.”

The Achilles heel to the entire fiat debt system worldwide is the dollar.

The dollar is the world’s reserve currency and there are nowhere near enough “real dollars” to cover the obligations of all these banks and they know it.

So the banks are starting to hoard their “real dollars” and charge huge interest rates to borrow them.

It’s a house of cards and it’s about to come crashing down.

“Liquidity crises don’t announce themselves. They appear in the form of sudden, unexplained actions by central banks — the kind that happen after hours, away from public scrutiny. When the Fed steps in like this, it’s usually trying to prevent a domino effect.”

“When a system needs $29 billion in overnight oxygen, it’s not healthy — it’s on life support.”

Federal Reserve Quietly Pumps $29.4 Billion Into Banking System

In the middle of the night, while most Americans were asleep, the Federal Reserve injected $29.4 billion into the U.S.

economiccollapse.report

economiccollapse.report

Watch SILVER, it will be the trigger again.

As I have been saying for a long time.

The Federal Reserve Note as the “world’s reserve currency,” is the Achilles heel of the entire financial system.

The Federal Reserve is the backstop for the entire world’s banking system.

Suddenly, there is a huge shortage of “cash” on hand.

Banks are charging high interest fees to lend their cash to other banks because there isn’t enough “overnight lending” cash to go around.

The FED is being FORCED to step in and provide the cash in order to prevent another big run on the banks.

“The next round of money printing is about to begin.

It’s not a question of “if,” but a question of “when.”

On the surface, everything seems hunky dory in the financial system. Stocks are at all-time highs. Bonds are stable. And the $USD appears to be finding its footing after losing 11% during the first half of the year.

However, “beneath the surface” things are beginning to unravel.

Since 2023, the Fed has drained some $2.38 trillion in reserves from the financial system via its Quantitative Tightening (QT) program. As a result of this and other recent developments, reserves (cash available for overnight/short-term lending) in the financial system have fallen to their lowest levels in FIVE years ($3 trillion).

That sounds like a lot of money, but it’s in fact quite low for what banks require to keep things running smoothly in the financial system. As a result of this, banks/ financial firms are turning to the Fed as a kind of “lender of last resort” for short-term liquidity/ financing needs. And not by a little: in the last two weeks, demands for overnight funding from the Fed have skyrocketed from nothing to over $50 billion.”

Even the FED president in Texas is saying more money printing is coming.

“So, while things look great in the financial system as far as stocks are concerned. The reality is that if the Fed doesn’t act quickly things could get UGLY fast.

In light of this, I fully believe the Fed will be forced to launch a new Quantitative Easing (QE) program in the next six months.

I’m not the only one.

Lorie Logan is the President of the Federal Reserve Bank of Dallas. As such she is one of 12 Fed Presidents. This is an extremely high-level insider at the Fed. And she just said the following…

“…..if the recent rise in rates on overnight repurchase agreements for Treasuries proves not to be temporary, the Fed will need to restart asset purchases [QE] to keep bank reserves ample…”

Fed Insider: “The Next Round of Money Printing is About to Begin!”

The next round of money printing is about to begin. It’s not a question of “if,” but a question of “when.” On the surface, everything seems hunky dory in the financial system. Stocks are at all-tim…

43s.159.myftpupload.com

43s.159.myftpupload.com

Does anybody think this shortage of cash for banks is “temporary?”

Or is it just the beginning?

I think the next big banking crisis, will trigger the beginning of the “public” transformation of the financial system.

The Trump reset is incoming.

Watch the SILVER price.

Some big banks are shorting millions of ounces of SILVER

The biggest SILVER squeeze in history is on the horizon.

Tough night for GOP in Virginia and New Jersey.

But srsly, did any of you think there was a chance to win either?

First of all Trump lost both in 2024. Did you REALLY think that would change in a span of 12 months?

New Jersey in the north is populated by the same people who are about to elect a jihadist commie in NYC and in the south the same people who elected a sub-90 IQ commie as mayor of Philly.

Virginia is completely controlled by the bazillion federal government workers who live in Northern Virginia and are totally PO'd that Trump is demolishing the pig trough they all wallow in.

The reason I have not commented on any of this at all before now was because to me tonight's results were inevitable and say absolutely nothing about 2026 or 2028.

In the days and weeks ahead you will see and hear eGOP scrubs who want MAGA out of their party saying that tonight was a rejection of MAGA. Don't fall for their propaganda--it's all selfish nonsense trying to take us back to the days of losing gracefully with Mittens Romney.

None of what these eGOP "pundits" will say about tonight is true. Tonight was simply a repeat of 2024, and nothing more.

So everybody please calm down.

On to 2026, where we DO need our focus.

Holy crap.

KAROLINE LEAVITT: We are working on an executive order. There is blatant FRAUD with their mail-in voting system. FRAUDULENT ballots are being mailed in under the names of other people and illegal aliens! There are COUNTLESS examples. And we are looking into executive action.

Common Sense

8h ·From Amy Mek on X

Zohran Mamdani didn’t quote Washington, Jefferson, or Lincoln.

He quoted Jawaharlal Nehru - the Marxist “founding father” of socialist India, who:

And now Mamdani quotes him as inspiration - calling this “the new age.”

Translation: the Nehru model of decline is being imported to America - socialism cloaked in red secularism, power masked as “progress.”

This is one GIANT STEP TOWARDS ISLAMIZATION!

Nehru destroyed India’s soul in the name of “progress.”

Mamdani is promising to do the same to you.

Christina Aguayo News

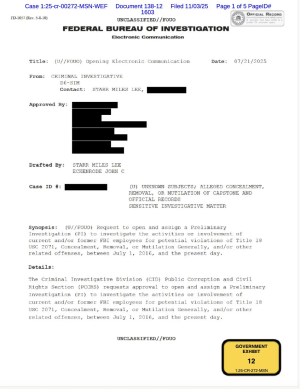

#news Contents of Obama-Era FBI 'burn bags', related to Trump, revealed in recently released documents

#Obama

Federal prosecutors have unsealed records detailing what was in the five "burn bags" that were stashed away in a secret back room at FBI headquarters - and discovered by Director Kash Patel's FBI.

#ChristinaAguayoNews

The bags were stuffed with classified documents tied to former Director James Comey's tenure - that many say weren't supposed to 'survive the burn."

#FBI

The bags had proof of the schemes and politically charged investigations run by Hillary Clinton and Barack Obama against President Donald Trump - including the debunked Trump-Russia collusion narrative.

The filing is being released as part of the ongoing prosecution against Comey and exposes the frantic scramble by FBI insiders to destroy the documents before Trump was inaugurated.

At the heart of the revelation is a document sent directly to Comey September 7, 2016 – a counterintelligence operational lead (CIOL).

This document was said to be missing for years, and contained intelligence related to foreign interference in the 2016 U.S. election.

However, Comey denied, under oath, ever seeing the document saying he was "unfamiliar" with it and the intelligence it contained.

The burn bags' triggered an FBI investigation into violations of the federal statute prohibiting the concealment, removal, or mutilation of government records and evidence.

Prosecutors argue the materials could expose systemic abuses within the bureau during the Obama-era investigations that targeted Trump.

Details from the unsealed records include:

Digital ID's are a risk. Another blow to the Digital ID world Agenda

bitnewsbot.com

bitnewsbot.com

India’s Aadhaar Data Breach Exposes 815M Records on Dark Web

Massive breach exposes 815 million Aadhaar records, highlighting critical vulnerabilities in India's digital ID system and raising urgent privacy concerns.- India’s Aadhaar digital ID system experienced a massive data breach exposing 815 million citizen records.

- Sensitive data including names, addresses, biometric details, and health records were leaked and sold on the Dark Web for about $80,000.

- Hackers exploited unpatched software vulnerabilities, bypassing biometric security like iris scans and fingerprints.

- Government websites allowed unregulated access to Aadhaar data via unsecured APIs, violating legal protections.

- This breach is one of the largest in India’s digital identity history, raising ongoing concerns about identity theft and fraud risks.

India's Aadhaar Data Breach Exposes 815M Records On Dark Web

India’s Aadhaar digital identification system has suffered a significant security breach, resulting in the leak of 815 million records. The exposed data was

I’ve gotten to the point that I do not trust any Chynese people that come to the US for their “education”. I believe that these people are sent by the CCP with the intention of stealing from us in one way or another. US universities have got to take a very detailed look at the Chynese students that they admit. ZFG.

Car exploded peacefully in the Bronx.

May have merely been a full gas tank exploding here. I’m certainly no explosives expert but have responded to many car fires and I’ve never seen one have an explosion like that. I’m curious to know what the investigation uncovers.

With the new mayor and if it is terrorism, doubtful it will be admitted. Will be more along the line of black criminals being labeled white people. They will never admit it if it is terrorism.May have merely been a full gas tank exploding here. I’m certainly no explosives expert but have responded to many car fires and I’ve never seen one have an explosion like that. I’m curious to know what the investigation uncovers.

May have merely been a full gas tank exploding here. I’m certainly no explosives expert but have responded to many car fires and I’ve never seen one have an explosion like that. I’m curious to know what the investigation uncovers.

I'm thinking it was just some dumbass starting a fire on the street and catching cars on fire then it got to the gas tank. 3rd worlders don't seem to understand simple stuff like "gas goes "boom"" .....May have merely been a full gas tank exploding here. I’m certainly no explosives expert but have responded to many car fires and I’ve never seen one have an explosion like that. I’m curious to know what the investigation uncovers.

A short time ago, I arrived back at @USTreasury after watching arguments before the U.S. Supreme Court on the International Emergency Economic Powers Act (IEEPA).U.S. Solicitor General D. John Sauer presented strong, persuasive arguments on the necessity of using IEEPA tariff authority to confront the emergencies President Trump has declared.

More importantly, the plaintiffs’ attorneys, Neal Katyal and Benjamin Gutman, espoused arguments that reflected foundational misunderstandings and misrepresentations about the Trump Administration’s trade goals.

Using IEEPA, President Trump has sought to rebalance decades of unfair trade against the United States that has brought us to a tipping point. The goal of his agenda is bringing back manufacturing and balancing the crisis-level deficits and trade barriers with our global trading partners.

The tariff income is incidental to these urgent goals – not the underlying reason for their application. In fact, as I have said many times, as the terms of trade are made more fair, U.S. manufactured items will replace imported goods. Tariff revenues will shrink, and U.S. domestic tax receipts will surge.

Showing their dramatic lack of economic understanding, Messrs. Katyal and Gutman argued that a President does have the authority to impose an embargo or quotas on other countries because those actions do not affect government revenues. Of course, they do. What embarrassing statements to make in front of SCOTUS.

Furthermore, in a statement bordering on the absurd, Oregon Solicitor General Gutman said that he believes IEEPA gives POTUS authority to impose a full embargo on a country but not a 1% tariff.

President Trump has used the IEEPA authority to address the fentanyl crisis, bring us back from the edge on trade policy, secure rare earths from China, and curtail the purchases of Russian oil – all urgent national security issues.

Economic Security is National Security, and IEEPA provides a powerful tool for President Trump to protect our people, our economy, and our nation.

Similar threads

- Replies

- 13

- Views

- 619

- Replies

- 6

- Views

- 366

- Replies

- 56

- Views

- 5K

- Replies

- 113

- Views

- 10K