I don’t know who these people think they are. Only the nba can fix nba games.

-

In Memory of Rebarcock.

As we navigate life without Pat 'Rebarcock.' Flood, who passed on Sept 21, 2025, we continue to remember the profound impact he had on our community. His support was a cornerstone for our forum. We encourage you to visit the memorial thread to share your memories and condolences. In honor of Pat’s love for storytelling, please contribute to his ‘Rebarcock tells a story’ thread. Your stories will help keep his spirit alive among us.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Master Thread Dance Your Cares Away/Fraggle/Law Abiding Citizens

- Thread starter Bryan74b

- Start date

Master Threads.

I've seen this before. The commie can't watch tho.

$4/pound butchered seems like a pretty good price to me. What do you expect to pay? Is the $3/pound based on it's live weight, or finished weight?

Live weight. Over double what I paid last time

Africa?I say keep the Mexicans and ship 95% of the black people somewhere. Everyone would be better off…. Except the place they were sent to

Over double is pretty crazy, but what does that come out to? I'm seeing that a typical live weight to fully processed product is around 43%. If that's accurate, you'd be looking at an 1800# live weight, with a yield of about 750#.Live weight. Over double what I paid last time

So $7200/750 = $9.60/Lb.

I guess it depends on the quality of beef that you're getting. I typically order around 100# of beef at a time, but it definitely gets expensive these days.

JFK was right when he said he wanted to "splinter the CIA into a thousand pieces and scatter it into the winds.” Is it possible to do it now? Or do we keep going downhill until our inevitable complete collapse as a country?

The Domino Effect Begins: Jamie Dimon’s Cockroach Warning Coming To Fruition

Jamie Dimon’s recent warning that when you see one cockroach, there are probably more is now playing out almost line for line. First came Tricolor Holdings, a subprime auto lender that collapsed under the weight of bad loans and alleged fraud. Then First Brands, a heavily indebted auto parts manufacturer, filed for Chapter 11. Now, PrimaLend Capital Partners, another subprime lender has fallen after defaulting on its bond payments, pushed into bankruptcy by unpaid creditors.

These aren’t isolated blowups; they’re the first visible cracks in a broader credit contraction that’s been quietly building beneath the surface. What links them all is the same structure of fragility: loans to high risk borrowers, funded through short term credit and securitized into complex bonds that depend on constant refinancing. When the Fed held rates near zero, that model worked but after two years of policy tightening and an average fed funds rate above 4.4%, the entire subprime ecosystem is choking on its own leverage.

The subprime auto sector is the perfect early warning signal because it sits at the intersection of consumer stress and financial engineering. Borrowers with weaker credit are defaulting at rising rates, repossessions are spiking, and lenders like PrimaLend that rely on bond markets for funding are discovering those markets have no appetite for risk. This is about a chain reaction through the private credit and asset backed markets that financed them.

Dimon’s cockroaches aren’t just in subprime auto, they’re spread across the shadow banking system. Many private credit funds, BDCs, and securitized lenders hold similar exposure, marked to model rather than market. The first failures are surfacing where consumers feel the pinch first, but as liquidity tightens further, the stress will migrate up the credit spectrum, from auto loans to small business credit, to leveraged corporates, and eventually to the banks that lent to them.

These bankruptcies are the financial equivalent of the first tremors before an earthquake. What looks contained in subprime auto today is really the credit cycle shifting into its next phase, one where overextended lenders, not just borrowers, start defaulting. The cockroaches are moving fast, and the lights have only just come on.

FWIW

Insider Trading is their preferred illegal activity. Pays way better than gambling.

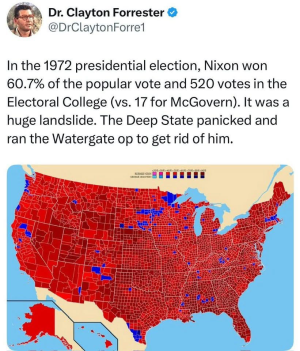

The colors are reversed.. It used to be blue for pubs and red for dems until dems realized they were being associated with their true red communist colors so they switched to blue around 1980 or so.

George dined at Epstein’s house after Epstein’s first child trafficking conviction. GS cannot be trusted for anything. ABC News is complicit in covering this up.

But what do US-EU-UK sanctions on Russian oil actually do?

I’ll explain:

1) Sanctioned products cannot be transported by ships anymore with western insurance and by western shipping companies.

2) Eastern shipping companies take over, like the fleet of Chinese ships that now transport Russian oil.

3) These ships now use another insurance, from China or from Russia. (Which was not existent before, or were not widely used)

4) Now the same amount of oil is transported, but without being insured in England and by BRICS ships. That is what they called “shadow fleet”.

-> England lost its shipping insurance monopoly, which is very bad for the UK.

Starmer celebrates essentially the handover of a British traditional market to BRICS.

Think about what trump is doing, he cannot say hey allies don’t start the war or I will place tariffs on you. Like Sun Tzu says‘

Sun Tzu’s The Art of War repeatedly stresses that the wise leader—whether a general or sovereign—prioritizes peace and strategic restraint over rash conflict, even when external pressures (from rulers, allies, or circumstances) demand action. He views unnecessary war as a failure of leadership, one that exhausts resources and endangers the state.

Sun Tzu teaches that true mastery lies in resolving threats without violence, demoralizing or outmaneuvering the enemy to force submission. This is the ultimate way to “have peace” amid warlike pressures:

“Hence to fight and conquer in all your battles is not supreme excellence; supreme excellence consists in breaking the enemy’s resistance without fighting.”

Sun Tzu explicitly empowers the leader to defy orders for ill-advised aggression, recognizing that blind obedience to a war-hungry sovereign or council can lead to ruin. The general must judge based on advantage, not authority:

“There are roads which must not be followed, armies which must not be attacked, towns which must not be besieged, positions which must not be contested, commands of the sovereign which must not be obeyed.”

Sun Tzu casts the leader as the “arbiter of the people’s fate,” responsible for shielding the nation from the “evils of war” that others might provoke out of anger, pride, or impatience:

“Thus it may be known that the leader of armies is the arbiter of the people’s fate, the man on whom it depends whether the nation shall be in peace or in peril.”

That's a lot of chum.

Future proves past

We found a guy who will come out and kill the cow, cut in quarters then haul it off to butcher it. He's half of other people around here. I'm assuming because he's just doing a few out of converted freezer trailer and he doesn't have to fool with getting rid of the remains.Yeah butchers are no joke. Same over here.

I say keep the Mexicans and ship 95% of the black people somewhere. Everyone would be better off…. Except the place they were sent to

What is the reason black people can't hear the chirp? That sound annoys me to hell and I will tear out a wall if I can't find a battery to fix it. These people let it chirp for months until it goes completely dead.

FWIW

I knew Terry Rozier was trash when he picked his college team....

Chum and cocaine -- a sharks dream.That's a lot of chum.

Similar threads

- Replies

- 13

- Views

- 610

- Replies

- 6

- Views

- 347

- Replies

- 0

- Views

- 2K

- Replies

- 56

- Views

- 5K