-

In Memory of Rebarcock.

As we navigate life without Pat 'Rebarcock.' Flood, who passed on Sept 21, 2025, we continue to remember the profound impact he had on our community. His support was a cornerstone for our forum. We encourage you to visit the memorial thread to share your memories and condolences. In honor of Pat’s love for storytelling, please contribute to his ‘Rebarcock tells a story’ thread. Your stories will help keep his spirit alive among us.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Master Thread Dance Your Cares Away/Fraggle/Law Abiding Citizens

- Thread starter Bryan74b

- Start date

Master Threads.

Mayor of New York City . . . but, yeah.

Another conspiracy theory proved true about LAC coming to late

Harry S. Truman gutted the White House in 1948.

Teddy Roosevelt built the West Wing.

FDR built a swimming pool when he added the East Wing.

Obama added a basketball court.

Nixon built a bowling alley.

Last year it is reported the government rented several large tents for large gatherings costing over a $1 million. All of the items were paid by tax dollars

Trump is adding a ballroom paid for by private donations.

Teddy Roosevelt built the West Wing.

FDR built a swimming pool when he added the East Wing.

Obama added a basketball court.

Nixon built a bowling alley.

Last year it is reported the government rented several large tents for large gatherings costing over a $1 million. All of the items were paid by tax dollars

Trump is adding a ballroom paid for by private donations.

This morning, FBI Milwaukee executed a major violent gang takedown called "Operation Chalkline" utilizing 14 SWAT teams in Milwaukee and Racine.

FBI Milwaukee special agents and task force officers (TFO) arrested 22 subjects on federal charges and executed 24 federal search warrants alongside local, state, and federal partners.

Among the items seized in the investigation:

The investigation was led by a Mount Pleasant Police Department TFO as part of the FBI Milwaukee Area Safe Streets Task Force which included TFOs from the Caledonia Police Department, Mount Pleasant Police Department, Racine County Sheriff’s Office, and Racine Police Department.

Additional local, state, and federal law enforcement partners assisted in the operation which included the Cudahy Police Department, Milwaukee County Sheriff’s Office, Milwaukee Police Department, Oak Creek Police Department, West Allis Police Department, Wisconsin Department of Justice – Division of Criminal Investigation, Wisconsin State Patrol, ATF, DEA, FBI, HSI, and the U.S. Marshals Service.

FBI Milwaukee continues to prioritize crushing violent crime together with our law enforcement partners to ensure public safety and security in Milwaukee, Racine, and throughout the state of Wisconsin.

The EU will collapse

Economist and forecaster Martin Armstrong (ArmstrongEconomics) joins Natural Resource Stocks to break down capital flows, the EU’s structural flaws, banking risk, and why his war and euro models are flashing a panic cycle next year. We dig into sanctions blowback, BRICS, gold as geopolitical insurance, and his provocative peace-and-industry proposal around rare earths.

Key Topics:• AI froth vs. “flight-to-safety” bid into the Dow during geopolitical risk.• Why the EU’s failure to consolidate debt dooms its bond market plumbing.

• How member-level debt holdings create contagion across EU banks.

• Germany’s energy shock, EV mandates, and shrinking industrial base.

• Migration shocks + recession = rising civil unrest.

• Gold moves on geopolitics more than CPI; central bank buying logic.

• Sanctions, SWIFT removal, and why that catalyzed BRICS realignment.

• 2026 “panic” risk in war and the euro.

• A rare-earths JV peace gambit: US capital + Russian know-how.

Chapters

00:00 Intro: “watching the world go insane”

00:58 Markets: AI bubble vs. safety flows into Dow

06:24 Will the EU collapse? Debt consolidation failure & banking risk

09:33 Germany’s policy spiral: energy, EVs, and jobs

12:03 Migration in downturns → unrest dynamics

20:57 US banks, gold’s geopolitics, and capital flows

24:37 SWIFT, sanctions, and the BRICS response

26:42 NATO talk, EU choices: war distraction vs. reckoning

27:53 Pensions, negative rates, and policy traps

33:45 Models: global conflict risk next year

38:12 Year-end into 2026: “panic” cycles in war and euro

41:20 Ukraine–NATO–EU political pressure anecdotes

42:58 Capital controls creeping across EU states

44:07 A peace plan brief for Washington (rare earths focus)

54:50 Where to read the proposal (ArmstrongEconomics)

57

Martin Armstrong: EU On the Brink, War Risk Next Year

Recorded on October 22, 2025.Economist and forecaster Martin Armstrong (ArmstrongEconomics) joins Natural Resource Stocks to break down capital flows, the EU’s structural flaws, banking risk, and why his war and euro models are flashing a panic cycle next year. We dig into sanctions blowback, BRICS, gold as geopolitical insurance, and his provocative peace-and-industry proposal around rare earths.

Key Topics:• AI froth vs. “flight-to-safety” bid into the Dow during geopolitical risk.• Why the EU’s failure to consolidate debt dooms its bond market plumbing.

• How member-level debt holdings create contagion across EU banks.

• Germany’s energy shock, EV mandates, and shrinking industrial base.

• Migration shocks + recession = rising civil unrest.

• Gold moves on geopolitics more than CPI; central bank buying logic.

• Sanctions, SWIFT removal, and why that catalyzed BRICS realignment.

• 2026 “panic” risk in war and the euro.

• A rare-earths JV peace gambit: US capital + Russian know-how.

Chapters

00:00 Intro: “watching the world go insane”

00:58 Markets: AI bubble vs. safety flows into Dow

06:24 Will the EU collapse? Debt consolidation failure & banking risk

09:33 Germany’s policy spiral: energy, EVs, and jobs

12:03 Migration in downturns → unrest dynamics

20:57 US banks, gold’s geopolitics, and capital flows

24:37 SWIFT, sanctions, and the BRICS response

26:42 NATO talk, EU choices: war distraction vs. reckoning

27:53 Pensions, negative rates, and policy traps

33:45 Models: global conflict risk next year

38:12 Year-end into 2026: “panic” cycles in war and euro

41:20 Ukraine–NATO–EU political pressure anecdotes

42:58 Capital controls creeping across EU states

44:07 A peace plan brief for Washington (rare earths focus)

54:50 Where to read the proposal (ArmstrongEconomics)

57

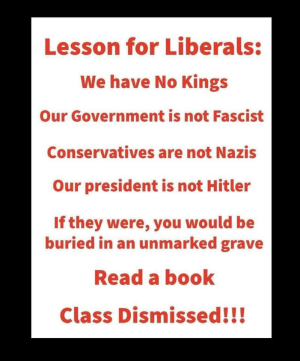

Hitler was more liberal then Trump. Change my mind.

The EU will collapse

Martin Armstrong: EU On the Brink, War Risk Next Year

Recorded on October 22, 2025.

Economist and forecaster Martin Armstrong (ArmstrongEconomics) joins Natural Resource Stocks to break down capital flows, the EU’s structural flaws, banking risk, and why his war and euro models are flashing a panic cycle next year. We dig into sanctions blowback, BRICS, gold as geopolitical insurance, and his provocative peace-and-industry proposal around rare earths.

Key Topics:• AI froth vs. “flight-to-safety” bid into the Dow during geopolitical risk.• Why the EU’s failure to consolidate debt dooms its bond market plumbing.

• How member-level debt holdings create contagion across EU banks.

• Germany’s energy shock, EV mandates, and shrinking industrial base.

• Migration shocks + recession = rising civil unrest.

• Gold moves on geopolitics more than CPI; central bank buying logic.

• Sanctions, SWIFT removal, and why that catalyzed BRICS realignment.

• 2026 “panic” risk in war and the euro.

• A rare-earths JV peace gambit: US capital + Russian know-how.

Chapters

00:00 Intro: “watching the world go insane”

00:58 Markets: AI bubble vs. safety flows into Dow

06:24 Will the EU collapse? Debt consolidation failure & banking risk

09:33 Germany’s policy spiral: energy, EVs, and jobs

12:03 Migration in downturns → unrest dynamics

20:57 US banks, gold’s geopolitics, and capital flows

24:37 SWIFT, sanctions, and the BRICS response

26:42 NATO talk, EU choices: war distraction vs. reckoning

27:53 Pensions, negative rates, and policy traps

33:45 Models: global conflict risk next year

38:12 Year-end into 2026: “panic” cycles in war and euro

41:20 Ukraine–NATO–EU political pressure anecdotes

42:58 Capital controls creeping across EU states

44:07 A peace plan brief for Washington (rare earths focus)

54:50 Where to read the proposal (ArmstrongEconomics)

57

lol on the brink of war.. Clearly you are not from around here.

This morning, FBI Milwaukee executed a major violent gang takedown called "Operation Chalkline" utilizing 14 SWAT teams in Milwaukee and Racine.

FBI Milwaukee special agents and task force officers (TFO) arrested 22 subjects on federal charges and executed 24 federal search warrants alongside local, state, and federal partners.

Among the items seized in the investigation:

More than 4 Kilograms of Cocaine

260 Grams of Fentanyl

1.5 Pounds of Methamphetamines

6 pounds of marijuana

23 Firearms

3 vehicles

The investigation was led by a Mount Pleasant Police Department TFO as part of the FBI Milwaukee Area Safe Streets Task Force which included TFOs from the Caledonia Police Department, Mount Pleasant Police Department, Racine County Sheriff’s Office, and Racine Police Department.

Additional local, state, and federal law enforcement partners assisted in the operation which included the Cudahy Police Department, Milwaukee County Sheriff’s Office, Milwaukee Police Department, Oak Creek Police Department, West Allis Police Department, Wisconsin Department of Justice – Division of Criminal Investigation, Wisconsin State Patrol, ATF, DEA, FBI, HSI, and the U.S. Marshals Service.

FBI Milwaukee continues to prioritize crushing violent crime together with our law enforcement partners to ensure public safety and security in Milwaukee, Racine, and throughout the state of Wisconsin.

Can we have the weed? Its legal anyway.. Why even list it?

Ah so he is the one that made it all out of balance.Teddy Roosevelt built the West Wing.

Do you have any idea how much wine the US is importing from Argentina?I actually don’t have a huge issue with the lowering tarrifs on Argentina, but his calling for ranchers or anyone for that matter to lower their prices is not good. If he wants to tackle the meat industry get the USDA out of the way of local processing

Also. Diplomatics.. The Queen of Holland is from there.

The problem with the meat (and other farm product) prices is that there is to many middle men in between all of it. The second thing would be some office people decide the prices, via the stockexchanges. You can do a bullrun tactic on for example corn.. Or during harvest periods extremely lower the prices.. Etc. You do the math.

That egg from the backyard is worth a few cents, the egg in the supermarket (in EU) 50 euro cent per egg.

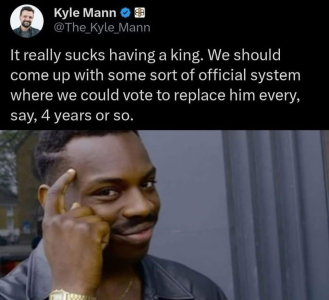

Why do you have to request the end to something that doesn’t exist?

Yep, was clear to us with how fema responded in our extremely red area. Hint, they didn’t respond for months & when they did they coordinated via churches & leaders of a certain race. They set up in our library & had two guards at the door decked out in full gear with rifles. They weren’t welcoming nor did they reach out to the broader community. We just ignored them with disdain & helped each other while much of the minority was taken care of by the Feds. Whatever

As I have explained on innumerable occasions, most notably in The Parasitic Mind, there is no violent Islamism, Islamism, radical Islam, militant Islam, or any other false qualifiers. Listen to the Muslim leaders and their imams. There is only Islam. The West has to decide whether greater Islam will yield more personal freedoms and liberties or lesser, and act accordingly. Kindness, compassion, tolerance, and empathy are understood differently by the Islamic mindset. They are interpreted as weakness, weakness, weakness, and weakness. Are you ready for Suicidal Empathy?

Similar threads

- Replies

- 13

- Views

- 609

- Replies

- 6

- Views

- 346

- Replies

- 0

- Views

- 2K

- Replies

- 56

- Views

- 5K