-

In Memory of Rebarcock.

As we navigate life without Pat 'Rebarcock.' Flood, who passed on Sept 21, 2025, we continue to remember the profound impact he had on our community. His support was a cornerstone for our forum. We encourage you to visit the memorial thread to share your memories and condolences. In honor of Pat’s love for storytelling, please contribute to his ‘Rebarcock tells a story’ thread. Your stories will help keep his spirit alive among us.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bond yields dropping again

- Thread starter quickfeet

- Start date

BigBucnNole

Elite

May have something to do with housing market slowing.

NFG

Tell_Sackett

Poster

It is all an illusion. The Fed has completely disconnected the bond market from reality.

Are you the thoughtful black guy from the picture? I bet you are, that sounds like something he would sayIt is all an illusion. The Fed has completely disconnected the bond market from reality.

Tell_Sackett

Poster

Even better.... I identify as him.Are you the thoughtful black guy from the picture? I bet you are, that sounds like something he would say

I was really hoping for a crash sooner than later. This cheddar is burning a hole in my pocket.May have something to do with housing market slowing.

Wonder what the implications of this are?

Just ANOTHER indicator that everything is overvalued? Or something else ...

Just ANOTHER indicator that everything is overvalued? Or something else ...

What you thinking?Wonder what the implications of this are?

Just ANOTHER indicator that everything is overvalued? Or something else ...

edit: as in big picture. I won’t hold you to it

What you thinking?

edit: as in big picture. I won’t hold you to it

I just think everything is overvalued right now. The government has pumped our economy full of steroids, i.e. free money.

There will be a cost to that free money, I just don't know what it is yet, nor when it will rear its ugly head. My most immediate concern is inflation and I see real estate as good a hedge as any. You will always value the roof over your head in proportion to other expenses. And with rentals or leases you can re-negotiate them usually on a yearly basis.

I'm not a big bond guy so don't know the implications of the junk bond market going below inflation. Here is a 5 year chart of junk bonds .... it seems pretty steady. So inflation rising is probably the bigger story in reference to the original post.

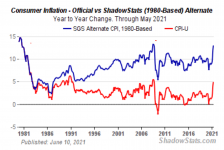

Acknowledging that this may be "Captain Obvious" but its my opinion that inflation is running a lot hotter than the official numbers being released.

I’m hedged very well with RE. Not particularly worried about myself and I’m in good position to really profit off inflation, but have enough reserves to capitalize on a popped bubble scenario.I just think everything is overvalued right now. The government has pumped our economy full of steroids, i.e. free money.

There will be a cost to that free money, I just don't know what it is yet, nor when it will rear its ugly head. My most immediate concern is inflation and I see real estate as good a hedge as any. You will always value the roof over your head in proportion to other expenses. And with rentals or leases you can re-negotiate them usually on a yearly basis.

I'm not a big bond guy so don't know the implications of the junk bond market going below inflation. Here is a 5 year chart of junk bonds .... it seems pretty steady. So inflation rising is probably the bigger story in reference to the original post.

Acknowledging that this may be "Captain Obvious" but its my opinion that inflation is running a lot hotter than the official numbers being released.

View attachment 31284

I’m worried about how much this financial experiment is going to fuck those with no real assets. And then the government is going to tax the middle class harder to push them down. I figured out how to side step a lot of bullshit taxation by running side businesses, but the lower and middle class is looking pretty fucked in the long term.

Tell_Sackett

Poster

One basic implication would be that the bond market is screaming inflation is highly transitory. I don't agree, but the BLS can smooth the CPI to whatever number strikes their fancy so they may be able to make it look transitory.Wonder what the implications of this are?

Just ANOTHER indicator that everything is overvalued? Or something else ...

Rates in all bond asset classes should be way higher.

Similar threads

- Replies

- 12

- Views

- 320

- Replies

- 20

- Views

- 2K