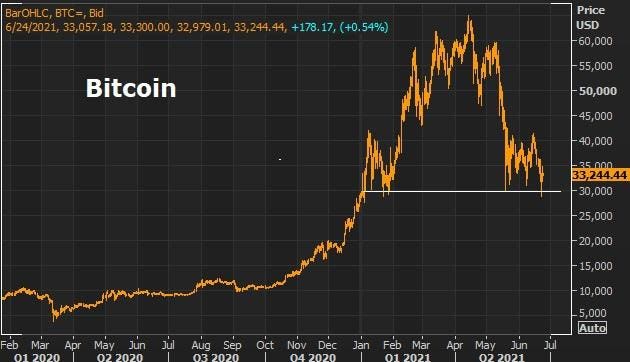

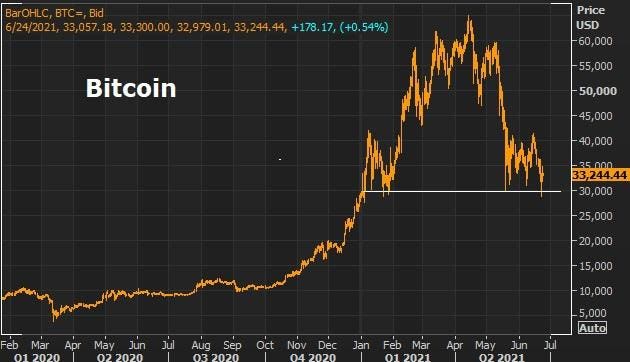

Say Goodbye To Bitcoin And Say Hello To The Digital Dollar

Yesterday we talked about the prospects of a digital dollar coming down the pike.

www.forbes.com

www.forbes.com

www.forbes.com

www.forbes.com

Just shows that there really is no positives no crypto. Only negatives unlike those other things you just listed.Why are these relevant to you? Fiat money has scams and bad actors, cars enable bad actors, the internet enables scams and bad actors, WiFi enables bad actors, etc.

I guess you think love and peace is negative? That’s what bitcoin represents.Just shows that there really is no positives no crypto. Only negatives unlike those other things you just listed.

I like bitcoin and what it represents. But I just have this feeling that the establishment and the federal reserve are going to do their best to try to destroy it. I hope I’m wrongI guess you think love and peace is negative? That’s what bitcoin represents.

No need for war over it like other metals and currency.. or indebt other countries in the dollar, no Triffen delima.

Could be,, who knows, but when there’s news of people in higher up places that have some, banks and institutions are in it… not sure how well it can be stopped.I like bitcoin and what it represents. But I just have this feeling that the establishment and the federal reserve are going to do their best to try to destroy it. I hope I’m wrong

I’m with you 100%. I just know that the establishment and the Fed like control and this is something they cannot controlCould be,, who knows, but when there’s news of people in higher up places that have some, banks and institutions are in it… not sure how well it can be stopped.

bitcoin overnight turned the image around of El Salvador… all peaceful.. and investments are going to happen. Worse case If fed outlaws it in the US, then buy land in el Salvador or other South American countries that will take it for payment.

It doesn't represent any of that IYAMI guess you think love and peace is negative? That’s what bitcoin represents.

No need for war over it like other metals and currency.. or indebt other countries in the dollar, no Triffen delima.

They already control it.I’m with you 100%. I just know that the establishment and the Fed like control and this is something they cannot control

Yeah no doubt.Yeah, Tether is a big question mark, and to be honest I have not taken the time to fully understand it. It may be one of those things that needs to burn though. It may cause temporary disruption if it happens, but in the long term BTC may be better off without it.

medium.datadriveninvestor.com

medium.datadriveninvestor.com

Really is time to do away with them completely.

Bye-bye, bitcoin: It’s time to ban cryptocurrencies

If China were on board, the possibility of a U.N. Security Council resolution to ban cryptocurrencies could be in the cards.thehill.com

Why Bitcoin Could be Banned or Criminalized in the Coming Years

Monetary system changes could become a big problem for Crypto fansmedium.datadriveninvestor.com

Five Reasons to Ban Bitcoins

Bitcoins have no instrinsic value and are the favorite currency for drug dealers and other criminals.www.opednews.com

It’s so sad.