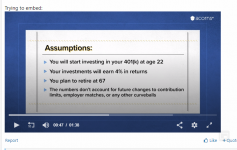

Edit: they changed the video to read 4%.

CNBC article and video (link) says that if you put in $100/week from 22 to 67 (45 years) with 6% annual return (no match, no salary increases) you will have $654,100. That is low by $500,000, it should be about $1.15 million. Why would they under estimate that? Perhaps they are accounting for 2% inflation, but why would they not disclose that?

If I were 22 and saw that in 45 years, I would have only $650K, I would not throw $100 a week to an account that I couldn't touch for 45 years.

Do they have an agenda?

Trying to embed:

CNBC article and video (link) says that if you put in $100/week from 22 to 67 (45 years) with 6% annual return (no match, no salary increases) you will have $654,100. That is low by $500,000, it should be about $1.15 million. Why would they under estimate that? Perhaps they are accounting for 2% inflation, but why would they not disclose that?

If I were 22 and saw that in 45 years, I would have only $650K, I would not throw $100 a week to an account that I couldn't touch for 45 years.

Do they have an agenda?

Trying to embed:

Last edited: