ThetaMale

Poster

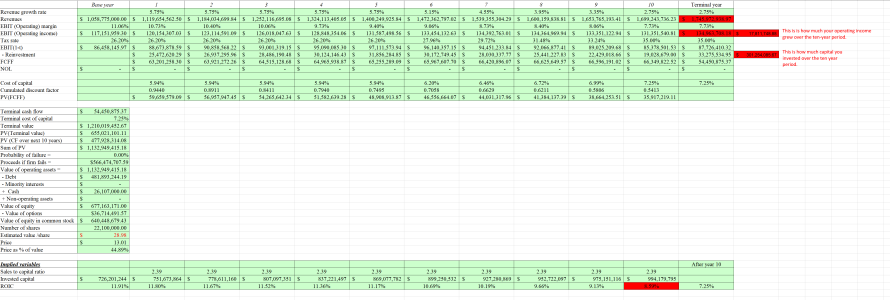

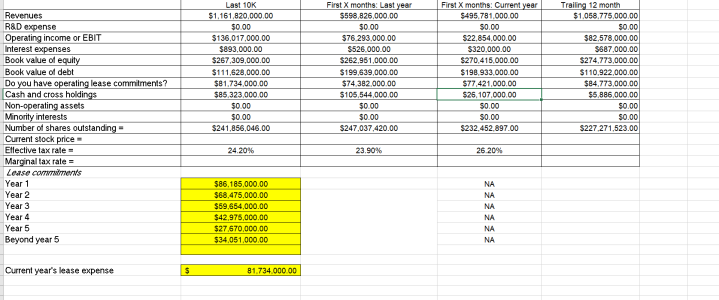

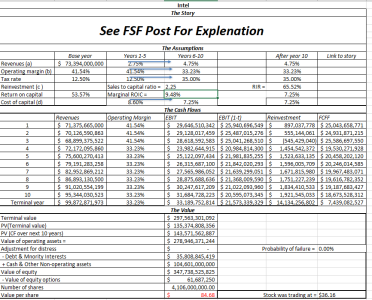

This valuation is not my first valuation of Intel. This valuation also needs quite a bit of work. However, I can say that most of my valuations on Intel have ended around the 58-62 range. After making some adjustments, though, and trying to account for Intel's current plan, this is what I have my valuation at in 10 years. This screenshot of a sheet gives a short rundown of my model. I'll try to provide a full rundown on the model itself on a different company because this doesn't show the changes I set to revenue growth or operating margin. It also leaves out some changes I already started making to reinvestment, and I'll wager that there's quite a bit I'll need to change. This valuation will probably take a few weeks to a month to finish.

The most encouraging factors for me are the construction of their new plant. Intel fell behind in chip manufacturing, but in recent years they have been able to compete with AMD on processors. Most consumers are unaware that Intel's chips are slowly becoming competitive again. The construction of their new plant and a recent tour of one of their chip factories make me think they may have come up with an improved manufacturing process or are on the verge of doing so. They've also been spending more on R&D in recent years.

Intel's growth averages around 4% over the years, with a standard deviation of +/- 4.73%. For the most part, Intel's revenue growth is consistent yearly. I assume they will continue to lose money until 2025, when they complete their factory. Once they've completed the factory, I expect consistent revenue growth of 4.75%, slightly over their average.

There are a few things I need to tweak with this, such as Intel's reinvestment. They've stated they plan to invest 100 billion over the next decade with planned expansions of their chip factory in Ohio.