Like the number of whores he sleighed?What was madoffs number?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FTX update: Sam Bankman Fried arrested

- Thread starter shiv

- Start date

He is going to restart FTX and is raising cash.

www.dailymail.co.uk

www.dailymail.co.uk

FTX founder Sam Bankman-Fried and celebrity backers hit by $11B suit

The suit filed in Florida names stars including Tom Brady, Gisele Bundchen, Shaquille O'Neal, Steph Curry and Larry David.

No, money he lost clients.Like the number of whores he sleighed?

Maxine Waters dodges question on FTX, Democrat ties and claims 'both sides' got money

Rep. Maxine Waters said she didn't "want to get into" whether Democrats who received campaign cash from FTX should give it back after the crypto exchange's bankruptcy.

Good news it is not SBF's fault. It is his ex GF fault:

www.dailymail.co.uk

www.dailymail.co.uk

Sam Bankman-Fried appears to blame his GIRLFRIEND for FTX collapse

Sam Bankman-Fried, 30, blamed his ex-girlfriend Caroline Ellison for the collapse of his company. Ellison is the owner of the company Alameda - who the FTX owner said lost his company's money.

What an evil bitch.

Maxine Waters dodges question on FTX, Democrat ties and claims 'both sides' got money

Rep. Maxine Waters said she didn't "want to get into" whether Democrats who received campaign cash from FTX should give it back after the crypto exchange's bankruptcy.www.foxbusiness.com

FTX was founded in 2019 and somehow managed to quickly become the biggest name in crypto

Sponsored the MLB and basketball arenas, SBF heavily lobbying members of Congress, his face is all over the place as "the next Warren Buffet"

View attachment 148688

How'd he elevate to such a position so quickly? Let's look at his parents

His dad has written about & made a career off of getting rid of the "cash economy" and helping the govt find tax evasion (odd that his son his the biggest name in crypto)

His mom is a major dem operative

View attachment 148689

View attachment 148690

Looks like the CEO of FTX (& SBF's gf) also has connections in high places

IMO, this whole thing seems like a weirdly arranged business/sexual partnership with ulterior motives

SBF was one of the largest donors to Democrat candidates, second only to...George Soros

BF gave the second largest donation to Joe Biden’s presidential campaign in 2020

View attachment 148691

One month after the war in Ukraine started, DC puppet Zelensky partnered with SBF for crypto donations...

View attachment 148692

We've come to find out that Sam's "minimalist, poor" lifestyle was completely a front..."I drive a Corolla!"

He lived in the Bahamas in a multi-million dollar mansion with his closest circle of friends where they'd have drug-fueled orgies apparently

View attachment 148693

Two weeks ago a big-named crypto developer who lived in PR was sounding the alarm on the CIA and m0ssad running a pedo elite cult in the Caribbean

View attachment 148694

View attachment 148695

Now for where it gets even more interesting...

Alameda Research headed up by Ellison (mentioned earlier) and under the FTX brand. Here's their logo

View attachment 148696

Let's not forget Sam - the man himself...

View attachment 148697

**************************************************************************************************************************

Wow wonderful Info

Chick is ugly, but is wild. Must be a tiger in the sack. Respekt her game.

www.dailymail.co.uk

www.dailymail.co.uk

Sam Bankman-Fried's ex-girlfriend wrote about being polyamorous

DailyMail.com has uncovered Caroline Ellison's Tumblr account where she wrote that she made a 'foray into poly', referring to having multiple partners.

Chick is ugly, but is wild. Must be a tiger in the sack. Respekt her game.

Sam Bankman-Fried's ex-girlfriend wrote about being polyamorous

DailyMail.com has uncovered Caroline Ellison's Tumblr account where she wrote that she made a 'foray into poly', referring to having multiple partners.www.dailymail.co.uk

Caroline Ellison, the chief executive of FTX sister company Alameda Research, wrote on her Tumblr account in February 2020 that she made a 'foray into poly,' referring to the practice of having multiple partners.

She said that in a polyamorous relationship everyone should have a 'ranking of their partners' and 'vicious power struggles for higher ranks.'

Ellison also wrote that characteristics of 'cute' boyfriends included 'controlling most major world governments' and 'sufficient strength to physically overpower you.'

Holy Shit!!! This shit is wild!!

Get us out fucking money!!!

www.dailymail.co.uk

www.dailymail.co.uk

Get us out fucking money!!!

Court filing says Sam Bankman-Fried 'moved digital assets to Bahamas'

FTX has claimed that formed CE Sam Bankman-Fried gained 'unauthorized access to FTX systems before moving 'digital assets' to Bahamian regulators.

No doubt she does aTm.Chick is ugly, but is wild. Must be a tiger in the sack. Respekt her game.

Sam Bankman-Fried's ex-girlfriend wrote about being polyamorous

DailyMail.com has uncovered Caroline Ellison's Tumblr account where she wrote that she made a 'foray into poly', referring to having multiple partners.www.dailymail.co.uk

Perfect Gif! Well done!!

McCarthy took FTX $$$ and spent it against MAGA politicians running for office.

https://www.zerohedge.com/markets/b...shed-out-300-million-during-ftx-funding-spree

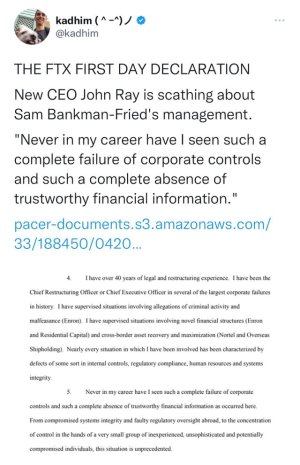

This is some of the most brazen fraud I've ever heard of.

I wonder if anyone at FTX ever heard a giant sucking sound while they were sitting in the office? You couldn't possibly drain that much money from a financial institution without someone hearing it.

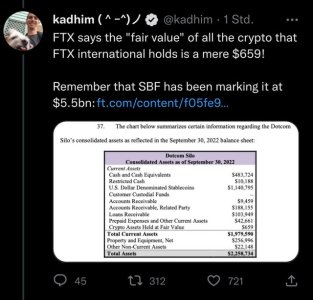

When FTX raised $420 million from an array of big-name investors in October last year right around the peak of the crypto bubble, at an FTX valuation of $25 billion, the cryptocurrency exchange said the money would help grow the business, improve user experience and allow it to engage more with regulators. In other words, a pure primary offering.

But as the Journal reports, what was left unmentioned was that nearly three-quarters of the money, $300 million, went instead to FTX founder Sam Bankman-Fried, who sold some of his personal stake in the company, according to FTX financial records reviewed by The Wall Street Journal. In other words, what was repped & warranted as a primary offering was really most a secondary. Which of course is completely criminal but in SBF's case it just means "get in line."

SBF's sale of stock in October 2021 came in the midst of a six-month fundraising blitz that ultimately brought in roughly $2 billion from investors including Sequoia Capital, funds managed by BlackRock and the Singapore sovereign wealth fund Temasek.

The October 2021 fundraising valued the company at $25 billion. In a press release, Bankman-Fried said he was happy “to partner with investors that prioritize positioning FTX as the world’s most transparent and compliant cryptocurrency exchange." Of course, it ended being everything but.

The amount raised contained numerical references to marijuana and oral sex: $420.69 million raised from 69 investors. An article published by one of FTX’s investors, Sequoia, called that fundraising a “meme round,” referring to the embedded jokes.

Three months earlier, in July 2021, Bankman-Fried bought out the roughly 15% stake owned by Binance, FTX’s first outside investor. Binance CEO Changpeng Zhao tweeted this month that the amount totaled $2.1 billion, paid in a combination of FTT, FTX’s in-house crypto currency, and BUSD, Binance’s stablecoin, whose value is pegged to the U.S. dollar.

After the July 2021 sale, the FTX shares Binance previously owned ended up in Paper Bird Inc., according to FTX documents. Paper Bird is an entity 100% owned by Mr. Bankman-Fried, according to documents on FTX filed with Miami-Dade County, in Florida.

Which means that in addition to the direct $300 million cash out, SBF also siphoned off $3.3 billion in "related party receivables" - as we noted yesterday, we already knew that $1 billion went directly to Bankman-Fried.

This is some of the most brazen fraud I've ever heard of.

I wonder if anyone at FTX ever heard a giant sucking sound while they were sitting in the office? You couldn't possibly drain that much money from a financial institution without someone hearing it.

He's still going to be speaking at the NYT event next week

www.marketwatch.com

www.marketwatch.com

'Why aren't you in jail already?' Internet erupts after Sam Bankman-Fried confirms participating in New York Times' DealBook

The disgraced founder of failed crypto exchange FTX will attend the New York Times's annual Dealbook conference

He's still going to be speaking at the NYT event next week

'Why aren't you in jail already?' Internet erupts after Sam Bankman-Fried confirms participating in New York Times' DealBook

The disgraced founder of failed crypto exchange FTX will attend the New York Times's annual Dealbook conferencewww.marketwatch.com

Maybe the will lure him there to arrest him?

Highly highly doubt, but that would be an epic conclusion. Seems like the powers that be are doing everything they can to protect himMaybe the will lure him there to arrest him?

Congress has already tried to stop the SEC investigation

prospect.org

prospect.org

Congressmembers Tried to Stop the SEC’s Inquiry Into FTX - The American Prospect

The ‘Blockchain Eight’ wrote a bipartisan letter in March attempting to chill the SEC’s information requests to crypto firms. FTX was one of those firms.

Congress has already tried to stop the SEC investigation

Congressmembers Tried to Stop the SEC’s Inquiry Into FTX - The American Prospect

The ‘Blockchain Eight’ wrote a bipartisan letter in March attempting to chill the SEC’s information requests to crypto firms. FTX was one of those firms.prospect.org

Hope you’re holding XRP.

This is already well in motion via Ripple and other blockchain providers (and available for use). They aren’t delivering XRP but actual fiat currency.

Regardless, the issue is “all underlying” accounts are held still held at banks.

Even a small fin tech / 3rd party payments provider who may have “digital wallets,” will still keep underlying balances at a bank.

So if we aren’t holding cash at banks, where are we? Government accounts?

Similar threads

- Replies

- 5

- Views

- 165

Support Free Speech

- Current cycle

- $1.00

- Total amount

- $623.00